In our latest Monthly Statistical Release, we show the main developments for the European investment fund market in December 2024 and include a first overview and analysis of the full year 2024.

Bernard Delbecque, Senior Director for Economics and Research at EFAMA, commented on the 2024 results: “Equity UCITS inflows rebounded in 2024, driven by strong stock market performance. Meanwhile, other UCITS categories followed similar trends to 2023: sustained demand for bond UCITS as interest rates declined, record-breaking net sales of both ETFs and MMFs, and continued net outflows from multi-asset UCITS”.

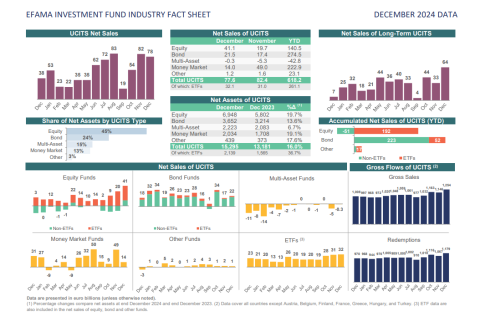

Thomas Tilley, Senior Economist at EFAMA, commented on the December 2024 figures: “Despite global stock markets edging lower, net sales of equity UCITS rose to a new 44-month high in December 2024. This was thanks to strong net inflows into equity ETFs, in addition to non-ETF equity funds returning to positive territory after being negative for most of the year.”

The main developments in 2024 can be summarised as follows:

UCITS and AIFs experienced net inflows of EUR 665 billion in 2024, marking a substantial increase from net sales of EUR 237 billion in 2023. The net assets of European investment funds grew by 13.2%, reaching a new record high of EUR 23.5 trillion.

- UCITS registered net sales of EUR 618 billion in 2024, more than tripling from EUR 183 billion in 2023.

- Net sales of equity UCITS rebounded strongly in 2024, driven by record inflows into equity ETFs. After muted net sales of just EUR 5 billion in 2023, net sales surged to EUR 141 billion, supported by the strong performance of global stock markets, particularly in the US. However, similar to the previous year, investors clearly preferred ETFs when investing in equity funds. Equity ETFs attracted a record EUR 192 billion in net new money, while non-ETF equity funds experienced net outflows of EUR 51 billion.

- Investors poured into bond UCITS as interest rates began to decline. Several major central banks cut rates in 2024, with markets anticipating further easing. This fueled annual net inflows of EUR 275 billion, nearly doubling the EUR 144 billion recorded in 2023 and marking the highest level since 2019. In contrast to equity UCITS, non-ETF bond UCITS dominated inflows, attracting EUR 223 billion, while bond ETFs saw net sales of EUR 52 billion.

- Multi-asset UCITS faced a second consecutive year of net outflows, though at a slower pace than in 2023. Net redemptions totalled EUR 43 billion in 2024, down from EUR 120 billion the previous year. This trend may reflect investors shifting from multi-asset UCITS into bond UCITS, as higher interest rates improved the risk-return trade-off in favour of bond funds.

- Money market funds (MMFs) achieved a record-breaking year, with net inflows reaching an all-time high of EUR 223 billion. The surge was largely driven by an inverted yield curve, which persisted for much of 2024 and made short-term assets more attractive. Additionally, strong inflows suggest that some investors opted for MMFs as a cash alternative, maintaining a wait-and-see approach in uncertain market conditions.

- 2024 marked another record year for ETFs. Net ETF sales soared to EUR 261 billion, far surpassing the previous record of EUR 169 billion in 2023. ETFs are increasingly the preferred investment vehicle for investors seeking exposure to US and global stock markets.

AIFs saw modest but positive net inflows. Net sales totalled EUR 47 billion, slightly below the EUR 54 billion recorded in 2023. Unlike UCITS, AIFs follow a different sales pattern due to their distinct investor base. Bond AIFs led net sales with EUR 39 billion, followed by multi-asset AIFs at EUR 37 billion. In contrast, equity AIFs saw net outflows of EUR 29 billion, largely due to continued transitions by Dutch and Danish pension funds from AIF structures to segregated mandates.

Analysing the data for December 2024, EFAMA highlighted the following:

- Net sales of UCITS and AIFs totalled EUR 80 billion, down from EUR 95 billion in November 2024.

UCITS recorded net inflows of EUR 78 billion, compared to EUR 82 billion in November 2024.

- Long-term UCITS (UCITS excluding money market funds) recorded EUR 64 billion of net sales, up from EUR 33 billion in November 2024. Of these, ETF UCITS saw net inflows of EUR 32 billion, slightly higher than the EUR 31 billion recorded in November.

- Equity funds registered net inflows of EUR 41 billion, up from EUR 20 billion in November 2024.

- Net sales of bond funds amounted to EUR 22 billion, compared to EUR 17 billion in November 2024.

- Multi-asset funds recorded net outflows of EUR 0.3 billion, compared to net outflows of EUR 5 billion in November 2024.

- Equity funds registered net inflows of EUR 41 billion, up from EUR 20 billion in November 2024.

- UCITS money market funds attracted net inflows of EUR 14 billion, down from EUR 49 billion in November 2024.

- Long-term UCITS (UCITS excluding money market funds) recorded EUR 64 billion of net sales, up from EUR 33 billion in November 2024. Of these, ETF UCITS saw net inflows of EUR 32 billion, slightly higher than the EUR 31 billion recorded in November.

- AIFs recorded net inflows of EUR 2 billion, compared to EUR 12 billion in November 2024.

- Total net assets of UCITS and AIFs decreased slightly by 0.01% to EUR 23.5 trillion.

-ENDS-

Notes to editors

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of communication & membership development