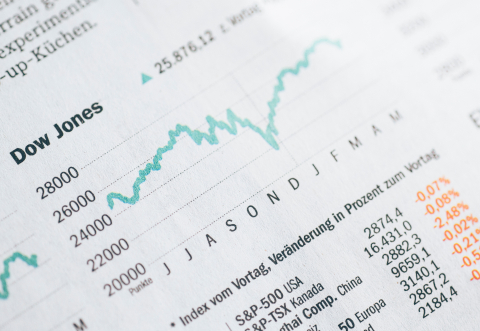

Capital markets

Investment managers, acting on behalf of their retail and institutional clients, are among the largest investors in financial markets. They represent a key component of the market’s “buy-side” segment.

In representing the interests of its members on wholesale capital market issues, EFAMA advocates for fair, deep, liquid, and transparent capital markets, supported by properly regulated and supervised market infrastructure.

EFAMA's reply to ESMA's CP on Draft technical advice on commercial terms for providing clearing services under EMIR (FRANDT)

EFAMA’s response to ESMA’s CP on data costs and consolidated tape

EFAMA welcomes proposal on affordable consolidated tape - The association continues to urge action on market data costs

EFAMA is pleased to read today the details of a robust MiFIR proposal from the European Commission addressing key areas of reform around the creation of a consolidated tape (CT), along with adjustments to transparency requirements on trading.

Buy-side use-cases for a real-time consolidated tape

A real-time consolidated tape, provided it is made available at a reasonable cost, will bring many benefits to European capital markets. A complete and consistent view of market-wide prices and trading volumes is necessary for any market, though this is especially true for the EU where trading is fragmented across a large number of trading venues. A real-time consolidated tape should cover equities and bonds, delivering data in ‘as close to real-time as technically possible’ after receipt of the data from the different trade venues.

Thank you to the Investment Management Forum sponsors | Register now!

Register now for our Investment Management Forum next week! High-calibre panels and keynote speakers promise rich, informative and thought-provoking exchanges between European policymakers, investment managers and regulators on

- the Competitiveness of our industry

- the EU retail investment strategy

- the latest in global standards for sustainability reporting

- challenges and opportunities of alternative investment regulations

- the impact of digitalisation on asset management

- and more...

3 questions to Agathi Pafili on CSDR

Q #1 What is the CSDR’s Settlement Discipline Regime (SDR) and what does it seek to achieve?

Asset Management in Europe - An Overview of the Asset Management Industry - November 2020

The report aims to provide a unique and comprehensive set of facts and figures on the state of the industry at the end of 2018 but also to highlight the fundamental role of asset managers in the financial system and wider economy.

Annual Review June 2019-June 2020

"It gives me great pleasure to provide you with an overview of our activities since our Annual General Meeting in Paris last year. While we were very much looking forward to hosting you all in Brussels this week, the current crisis and associated travel restrictions has forced us to improvise and turn our meeting into a virtual AGM.