EFAMA has today published its latest monthly Investment Fund Industry Fact Sheet, which provides net sales data on UCITS and AIFs for December 2022 at European level and by country of fund domiciliation. A first overview and analysis of the net sales data of UCITS and AIFs over the full year 2022 is also included.

Bernard Delbecque, Senior Director for Economics and Research at EFAMA, commented on the 2022 results: “2022 was a difficult year for UCITS and AIFs, which suffered net outflows of EUR 278bn, a level not seen since the financial crisis of 2008. On a positive note, ETFs and sustainable SFDR Article 9 funds continued to attract net new money, despite difficult market conditions. This outcome confirms that investor demand momentum (particularly institutional investors) remains with ETFs thanks to their low costs and trading flexibility, and with sustainable funds due to the expected long-term benefits of a sustainable investment approach in terms of lower downside risk and ESG impact.”

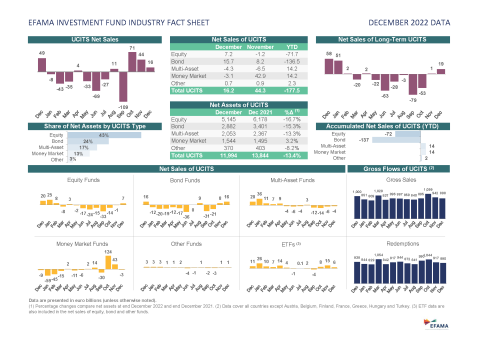

Thomas Tilley, Senior Economist at EFAMA, commented on the December 2022 figures: “Net sales of long-term UCITS rose to the highest level since January 2022 as equity funds attracted net inflows, despite a decline in stock markets, and weaker expectations of future increases in interest rates rekindled investor interest in bond funds.”

The main developments in 2022 can be summarised as follows:

UCITS and AIFs experienced net outflows of EUR 278bn in 2022, compared to net inflows of EUR 888bn in 2021. Net assets of European investment funds declined by 12.4%, to drop below the EUR 20 trillion threshold.

UCITS suffered net outflows of EUR 175bn in 2022, for the first time since 2011.

- Equity funds recorded net outflows of EUR 72bn. These net outflows represented 1.2% of the value of equity fund assets at the end of 2021. The slowdown in economic growth triggered by Russia’s war against Ukraine and the tightening of monetary policy undermined investor confidence and led to sharp falls in stock markets and net outflows from equity funds. Considering the significant worsening of the economic, financial and geopolitical environment, these outflows can be viewed as moderate.

- Bond funds recorded their worst year since 2008. They suffered net outflows of EUR 137bn, or about 4% of their net asset values at the start of 2022. Higher interest rates led to capital losses for bondholders, while the expectation that interest rates would continue to increase for some time deterred investors for most of the year.

- Multi-assets funds were the most popular type of long-term UCITS. They attracted EUR 14bn in new money. The greater diversification across asset classes gave these funds a competitive advantage in a down year for stock and fixed-income markets.

- Despite a challenging year, money market funds ended the year with positive net sales of EUR 14bn. This was a direct consequence of record-breaking net inflows in October (EUR 124bn), when the liability-driven investment (LDI) market crisis in the UK led pension funds using LDI strategies to sell government bonds and park large amounts of cash into Sterling MMFs domiciled in Ireland.

- 2022 was a good year for exchange-traded funds (ETFs). Net flows remained positive (EUR 85bn) thanks to ETF’s low costs and trading flexibility.

- The demand for SFDR Article 9 funds remained robust. These funds, which have an explicit sustainability objective, attracted EUR 26bn of net new money. This outcome is even more noticeable given the fact that many fund managers reclassified their Article 9 funds to Article 8 in the second half of the year as a result of the clarification provided by ESMA in June 2022 regarding the SFDR regulatory technical standards for Article 9 funds.

- Net sales of AIFs turned negative for the first time ever (EUR 101bn). This development can be explained by the decision taken by several pension funds in the Netherlands, and to a lesser extent in Denmark, to stop managing their assets within AIF wrappers and make more use of segregated mandates due to the new IFR/IFD prudential rules. Net sales of AIFs in other European countries remained positive and totalled EUR 112bn.

Analyzing the data for December 2022 in particular, EFAMA highlighted the following:

- Net sales of UCITS and AIFs totaled EUR 24bn, down from EUR 53bn in November 2022.

- UCITS recorded net inflows of EUR 16bn, compared to EUR 44bn in November 2022.

- Long-term UCITS (UCITS excluding money market funds) recorded EUR 19bn of net sales, up from EUR 1bn in November 2022.

- Equity funds registered net inflows of EUR 7bn, compared to net outflows of EUR 1bn in November 2022.

- Net sales of bond funds increased to EUR 16bn, up from EUR 8bn in November 2022.

- Multi-asset funds recorded net outflows of EUR 4bn, compared to net outflows of EUR 6bn in November 2022.

- UCITS money market funds recorded net outflows of EUR 3bn, compared to net inflows of EUR 43bn in November 2022.

- Long-term UCITS (UCITS excluding money market funds) recorded EUR 19bn of net sales, up from EUR 1bn in November 2022.

- AIFs recorded net inflows of EUR 8bn, compared to net inflows of EUR 9bn in November 2022.

- Total net assets of UCITS and AIFs decreased by 2.6% to EUR 19,139bn.

-ENDS-

Notes to editors

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of Communication & Membership Development

Tel: +32 2 548 26 52

Email: Hayley.McEwen@efama.org