EFAMA has today published its latest quarterly European statistics, tracking and analysing trends in European regulated open-ended fund assets and net flows during Q3 2021.

The main developments through the quarter are as follows:

- Net assets of UCITS and AIFs - Net assets of UCITS and AIFs grew 1.7% in Q3 2021, reaching EUR 20.8 trillion. UCITS net assets increased by 2%, whereas the net assets of AIFs grew by 1.3%.

- UCITS and AIFs Net Inflows - UCITS and AIFs attracted a total of EUR 200 billion in net inflows in Q3 2021. Net sales of UCITS amounted to EUR 179 billion, down from EUR 210 billion in Q2 2021. AIFs attracted EUR 21 billion in net new money over the quarter, compared to EUR 18 billion in Q2 2021.

- Net sales by Asset Class –After having recorded exceptionally high net inflows over the past three quarters, net sales of equity funds slowed down in Q3 2021, against the backdrop of more volatile stock markets but remained robust. At the same time, investors increased their purchases of bond and multi-asset funds, which enabled them to diversify their investment portfolios.

- Money market funds (MMFs) –Investors continued to reduce their net holdings of MMFs in Q3 2021, shifting their investments towards long-term funds.

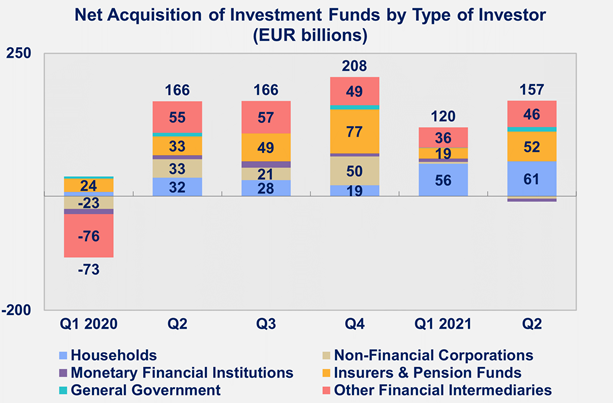

- European Households – Net acquisitions of investment funds by European households reached EUR 117 billion during the first half of 2021. Following the already strong fund purchases in Q1 2021 (EUR 56 billion), purchases by European households rose to EUR 61 billion in Q2 2021. German and Italian households were the largest retail investors in Q2 2021, but Spain, Belgium and the Nordic countries were not far behind.

Bernard Delbecque, Senior Director for Economics and Research – “The first half of 2021 was marked by a significant reallocation of savings of European households towards investment funds. This could reflect a rise in household awareness on the opportunity cost of saving too much in bank deposits - especially in an environment of ultra-low interest rates and rising inflation. The sustained demand for long-term UCITS observed in the third quarter of 2021 suggests that retail investors remained confident in the potential return prospects offered by UCITS.”

– Ends –

Please see the accompanying attachment for the EFAMA Investment Fund Industry Fact Sheet for Q3 2021.

Notes to editors:

For further information, please contact:

Brandon Bhatti

Hume Brophy

Daniela Haiduc

Head of Communications

+32-2-473 562 936

cc: info@efama.org

About the EFAMA Quarterly Statistical Release:

The release is published by EFAMA quarterly and presents net sales and net assets data for UCITS and AIF provided by 29 national associations. The contributing national associations are Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

About the European Fund and Asset Management Association (EFAMA)

EFAMA is the voice of the European investment management industry, which manages over EUR 27 trillion of assets on behalf of its clients in Europe and around the world. We advocate for a regulatory environment that supports our industry’s crucial role in steering capital towards investments for a sustainable future and providing long-term value for investors. More information available at www.efama.org.