EFAMA publishes its latest Monthly Statistical Release for July 2024.

Thomas Tilley, Senior Economist at EFAMA, commented: “Bond UCITS continued to be the best-selling long-term funds category in July, as investors continued to anticipate future interest rate cuts.”

The main developments in July can be summarised as follows:

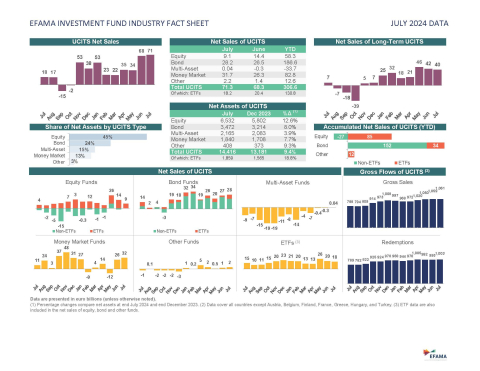

UCITS and AIFs recorded net inflows of EUR 77bn, up from EUR 75bn in June.

UCITS attracted net inflows of EUR 71bn, compared to EUR 68bn in June.

Long-term UCITS (UCITS excluding money market funds) saw net inflows of EUR 40bn, slightly down from EUR 42bn in June. Of these, EUR 18bn went into ETF UCITS, compared to EUR 20bn in June.

Equity UCITS registered net inflows of EUR 9bn, down from EUR 14bn in June.

Bond UCITS saw net inflows of EUR 28bn, slightly higher than the EUR 27bn recorded in June.

Multi-asset UCITS returned to positive territory for the first time since February 2023, though with modest net inflows of EUR 0.04bn, compared to net outflows of EUR 0.3bn in June.

Money market (MMF) UCITS attracted net inflows of EUR 32bn, up from EUR 26bn in June.

AIFs recorded net inflows of EUR 6bn, compared to EUR 7bn in June.

Total net assets of UCITS and AIFs grew by 1%, to EUR 22,369bn.

-ENDS-

Notes to editors

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of communication & membership development