EFAMA publishes its latest Monthly Statistical Release for August 2024.

Hailin Yang, Data Analyst at EFAMA, comments: “In August, the market environment remained positive, with all UCITS categories except multi-asset funds showing positive net sales. Money market funds registered the highest net sales, but also ETFs continued to draw solid net inflows.”

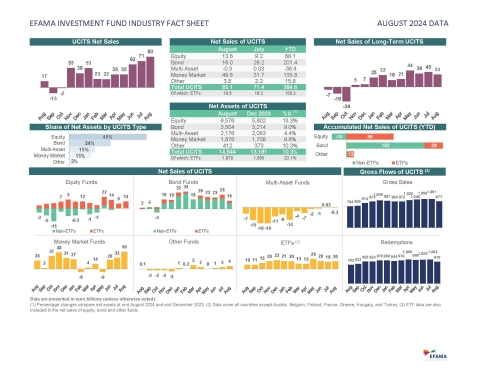

The main developments in August can be summarised as follows:

- UCITS and AIFs recorded net inflows of EUR 82bn, up from EUR 77bn in July.

- UCITS attracted net inflows of EUR 83bn, an increase from EUR 71bn in July.

- Long-term UCITS (UCITS excluding money market funds) saw net inflows of EUR 33bn, down from EUR 40bn in July. Of these, EUR 20bn flowed into ETF UCITS, compared to EUR 18bn in July.

- Equity UCITS registered net inflows of EUR 14bn, up from EUR 9bn in July.

- Bond UCITS recorded net inflows of EUR 16bn, down from EUR 28bn in July.

- Multi-asset UCITS returned to negative territory, with net outflows of EUR 0.3bn, compared to net inflows of EUR 0.03bn in July.

- Money market (MMF) UCITS attracted strong net inflows of EUR 50bn, up from EUR 32bn in July.

- Long-term UCITS (UCITS excluding money market funds) saw net inflows of EUR 33bn, down from EUR 40bn in July. Of these, EUR 20bn flowed into ETF UCITS, compared to EUR 18bn in July.

- AIFs recorded net outflows of EUR 1bn, compared to net inflows of EUR 6bn in July.

- Total net assets of UCITS and AIFs grew by 0.6%, reaching EUR 22,505bn.

-ENDS-

Notes to editors

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of communication & membership development