EFAMA has today published its European Quarterly Statistical Release for Q3 of 2024.

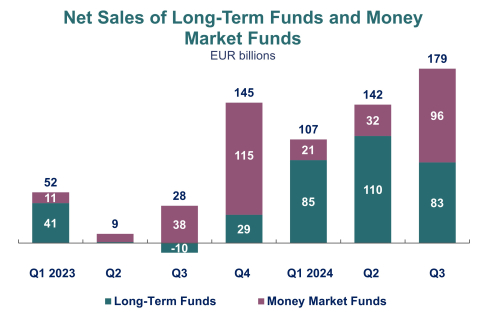

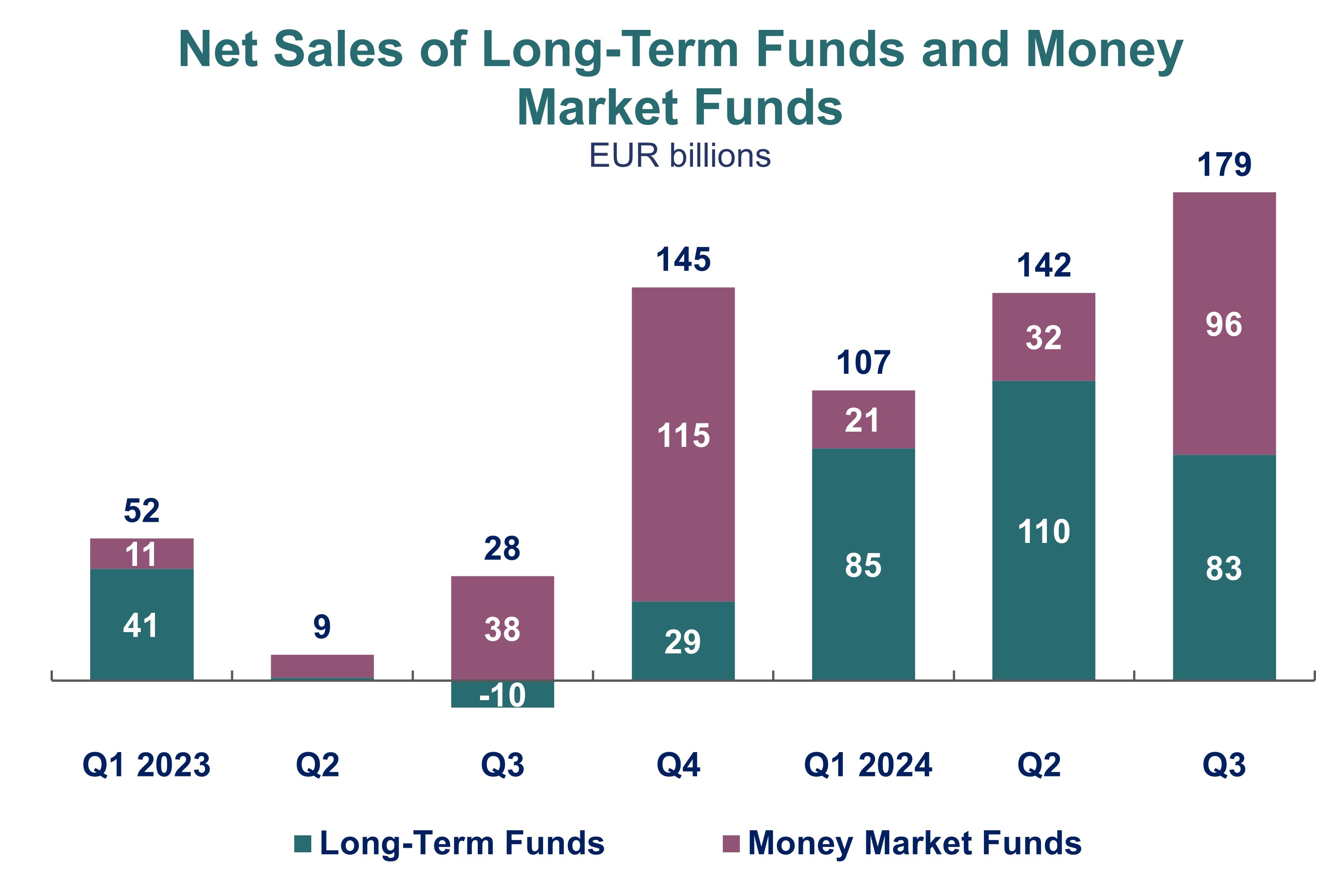

Thomas Tilley, Senior Economist at EFAMA, commented: “Net inflows into long-term funds slowed during the third quarter of 2024, while money market funds attracted strong net sales. In times of market volatility, MMFs often serve as a ‘safe haven’ investment option for investors.”

The main developments in Q3 2024 are as follows:

Net assets of UCITS and AIFs grew by 2.7% in Q3 2024.

UCITS and AIFs saw robust net inflows of EUR 179 billion in Q3 2024. Net sales of UCITS amounted to EUR 174 billion, while AIFs registered net inflows of EUR 5 billion.

Long-term funds registered net inflows of EUR 83 billion, down from EUR 110 billion in Q2 2024. Despite the decline, all categories of long-term funds saw positive net inflows this quarter.

- Money market funds recorded significant net inflows of EUR 96 billion, compared to EUR 32 billion in Q2 2024.

ETFs maintained their positive momentum. UCITS ETFs recorded net sales of EUR 57 billion, bringing year-to-date inflows to EUR 170 billion—already surpassing the total for 2023 (EUR 169 billion).

SFDR Article 9 funds continued to experience net outflows. LT Article 9 funds recorded net outflows of EUR 3.2 billion in Q3 2024, whereas LT Article 8 funds registered net inflows of EUR 37.5 billion.

European households maintained their appetite for investment funds in Q2 2024, with net fund acquisitions reaching EUR 62 billion.

-ENDS-

Notes to editors

Chart

About the EFAMA Quarterly Statistical Release:

The release is published by EFAMA every quarter and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom. It also includes a section providing information on the owners of investment funds in Europe and their net purchases of funds.

For further information, please contact:

Hayley McEwen

Head of communications & membership development