EFAMA is pleased to launch the first edition of its new Industry Perspective research series, entitled “The rise of active ETFs in Europe – A short overview”.

This publication gives a brief summary of the active ETF market in Europe, including its characteristics, growth over time, and comparison to the active ETF market in the US.

Key trends in active ETFs:

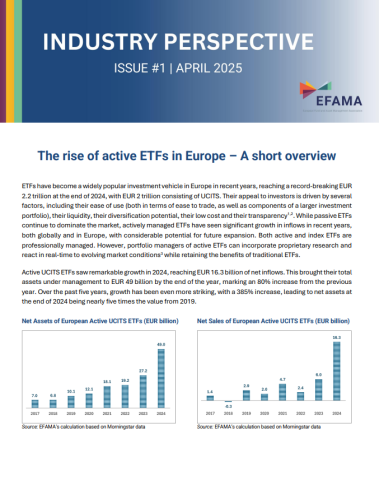

- Actively managed ETFs have seen significant growth in Europe in recent years, experiencing €16.3 billion of net inflows in 2024 and reaching total assets under management of €49 billion by the end of the year.

- Over the past five years, the UCITS active ETF market has increased by 385%, leading to net assets at the end of 2024 being nearly five times the value compared to 2019.

- The share of active UCITS ETFs within the total UCITS ETFs market is still low at 2.4% in 2024, however it is steadily increasing and nearly doubled from 1.3% seen at the end of 2019.

- The active UCITS ETF market still lags behind the active ETF market in the US, which represents 8.4% of the total US ETF market and reached net assets of €867 billion at the end of 2024.

- The higher share of active ETFs in the US can be partly attributed to the larger retail investor base and additional tax benefits available to US investors in these products.

Prospects are positive for the continued adoption of active ETFs in Europe due to strong institutional client demand for alpha-generating strategies, the rise of fee-based distribution models (e.g. through model portfolios), and increasing retail investor use of trading platforms.

- ENDS -

For further information, please contact:

Hayley McEwen

Head of communications and member development