For immediate release

Worldwide fund net assets increase in final quarter of 2019

Brussels, 25th March 2020 - The European Fund and Asset Management Association (EFAMA), has today published its latest International Statistical Release describing the trends in worldwide investment fund industry in the fourth quarter of 2019*.

Worldwide regulated open-ended fund assets increased by 3.1 percent to EUR 52.7 trillion in the fourth quarter of 2019. Worldwide net cash flow to all funds amounted to EUR 808 billion, compared to EUR 622 billion in the third quarter of 2019.

Bernard Delbecque, Senior Director for Economics and Research commented: Net sales of equity funds rebounded strongly during the fourth quarter of 2019, as investor confidence strengthened at that time against the background of improved economic conditions".

Other main developments in the worldwide investment fund industry in the fourth quarter of 2019 include:

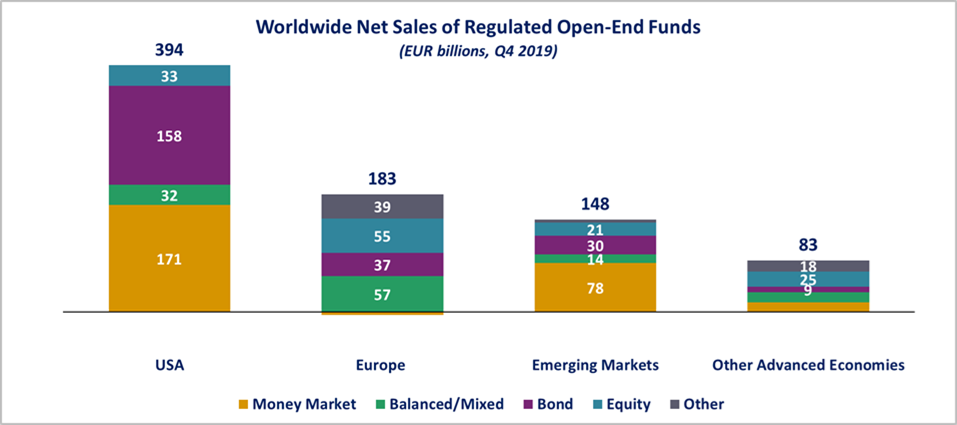

- Rebound in net sales of equity funds. After three quarters of negative or nearly zero net sales, net inflows into equity funds rose to EUR 134 billion in Q4 2019. Equity flows recovered across the board but were primarily driven by Europe (EUR 55 billion), followed by the United States (EUR 33 billion).

- Net sales of bond funds remained strong. Net sales of worldwide bond funds amounted to EUR 234 billion in Q4 2019, compared to EUR 245 billion the previous quarter. The United States (EUR 158 billion) and China (EUR 49 billion) accounted for the majority of global net sales.

-

Strong net sales of money market funds. Money market funds attracted EUR 259 Billion in net new money in Q4 2019, compared to EUR 279 billion in Q3 2019. Again, the vast majority of net sales was registered in the United states (EUR 171 billion) and China (EUR 66 billion), whereas Europe registered net outflows of only EUR 5 billion.Ends

*Please see the accompanying attachment for the EFAMA International Statistical Release (Q4 2019).

accompanying attachment for the EFAMA International Statistical Release (Q4 2019).

For media enquiries, please contact:

Hume Brophy

Kerri Anne Rice kerrianne.rice@humebrophy.com

Paul Andrieu paul.andrieu@humebrophy.com

info@efama.org

Notes to editors:

About the report

The report for the fourth quarter of 2019 contains statistics from the following 47 countries: Argentina, Brazil, Canada, Chile, Costa Rica, Mexico, Trinidad & Tobago, United States, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Lichtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, Australia, China, India, Japan, Rep. of Korea, New Zealand, Pakistan, Philippines, Taiwan, South Africa.

About the European Fund and Asset Management Association (EFAMA):

EFAMA, the voice of the European investment management industry, represents 28 member associations and 60 corporate members. At end 2019, total net assets of European investment funds reached EUR 17.8 trillion. These assets were managed by close to 34,200 UCITS (Undertakings forCollective Investments in Transferable Securities) and 29,000 AIFs (Alternative Investment Funds). More information available at www.efama.org.