Capital Markets Union

Building a Capital Markets Union (CMU) serving the needs of European citizens and businesses is as ambitious as it is essential: the effort will enable pensioners and savers to share in the upside of Europe’s economic recovery. In the process, European capital markets also become more efficient and better integrated. This long-term vision is key to financing European innovation and to supporting the transition towards a more sustainable economy.

Increasing retail investors’ participation in capital markets is an essential component for building an effective CMU. Improving access to financial and non-financial information and addressing the high data costs our industry is encountering, are also important steps towards a functioning CMU. All this, while maintaining and improving the attractiveness of the European investment management sector in today's global environment.

EFAMA prepared a list of key actions that are required to reach the CMU objectives from an investor perspective. We have also developed a specific Key Performance Indicator to measure year-on-year progress towards increasing retail participation in capital markets in each member state.

Joint EU Trade Associations' views on ‘Review of the European System of Financial Supervision’

EFAMA on EC Proposal on low-carbon benchmarks and positive carbon impact benchmarks

EFAMA comments European Commission's Proposal on disclosures relating to sustainable investments

Thank you to the Investment Management Forum sponsors | Register now!

Register now for our Investment Management Forum next week! High-calibre panels and keynote speakers promise rich, informative and thought-provoking exchanges between European policymakers, investment managers and regulators on

- the Competitiveness of our industry

- the EU retail investment strategy

- the latest in global standards for sustainability reporting

- challenges and opportunities of alternative investment regulations

- the impact of digitalisation on asset management

- and more...

Statement on the release of the Oliver Wyman study ‘Caught on Tape’

“Oliver Wyman’s study ‘Caught on Tape’ provides a perplexing take on Consolidated Tape for Europe. Sure enough, it starts with accurate observations: the high number of trading venues in Europe, the resultant fragmented liquidity, unseen liquidity due to the lack of a consolidated tape, and the fact that leading markets like the US and Canada today benefit from a real time consolidated tape.

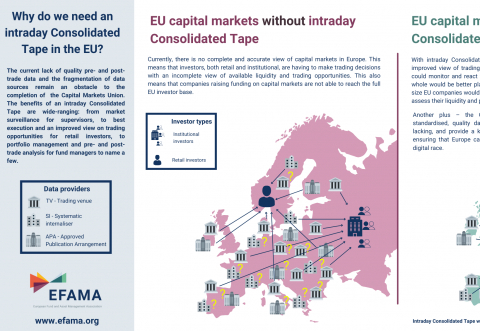

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.

Household Participation in Capital Markets

This publication precedes the European Commission's forthcoming new Action Plan on the Capital Markets Union (CMU). It includes ten concrete policy recommendations to help advance the CMU, including the introduction of a Key Performance Indicator (KPI) to monitor progress in household participation in capital markets.