Capital Markets Union

Building a Capital Markets Union (CMU) serving the needs of European citizens and businesses is as ambitious as it is essential: the effort will enable pensioners and savers to share in the upside of Europe’s economic recovery. In the process, European capital markets also become more efficient and better integrated. This long-term vision is key to financing European innovation and to supporting the transition towards a more sustainable economy.

Increasing retail investors’ participation in capital markets is an essential component for building an effective CMU. Improving access to financial and non-financial information and addressing the high data costs our industry is encountering, are also important steps towards a functioning CMU. All this, while maintaining and improving the attractiveness of the European investment management sector in today's global environment.

EFAMA prepared a list of key actions that are required to reach the CMU objectives from an investor perspective. We have also developed a specific Key Performance Indicator to measure year-on-year progress towards increasing retail participation in capital markets in each member state.

The PEPP - Engaging the young generation of European savers

EFAMA Response to EC Consultation: Capital Markets Union mid-term review 2017

• EFAMA reiterates the European asset management industry’s strong support for the CMU project in all its dimensions. We welcome the range of initiatives, from the overarching aim of rebuilding confidence in financial markets by putting investors’ interests at the heart of the project, to the promotion of market-based financing of the economy, the development of a PEPP or the development of a comprehensive strategy on sustainable finance.

Review of EU Macro-Prudential Policy Framework - EFAMA response to EC Consultation

EFAMA welcomes the opportunity to respond to the European Commission’s consultation envisaging the review of the EU macro-prudential policy framework. The consultation paper emphasises the review of the existing prudential framework built around the systemic nature of credit institutions and at the cornerstone of which lies the CRD/CRR, accompanied by the ESRB Regulation and the foundation of a Single Supervisory Mechanism (SSM) for a Banking Union, in turn revolving around the ECB.

Monthly Statistics November 2020 | News of vaccines drove record net sales of UCITS equity funds

The European Fund and Asset Management Association (EFAMA) has today published its latest monthly Investment Fund Industry Fact Sheet, which provides net sales data of UCITS and AIFs for November 2020*.

Initial reactions on the new Capital Markets Union action plan - Keynote by Tanguy van de Werve

6th Cyprus International Funds Summit - 16 November 2020

An appropriately constructed Consolidated Tape could help to build deeper and more open capital markets in Europe

EFAMA and EFSA welcome the publication of a Market Structure Partners Study on the Creation of an EU Consolidated Tape which addresses the challenges, demand, benefits and proposed architecture for consolidating European financial market data.

Household Participation in Capital Markets

This report analyses the progress made in recent years by European households in allocating more of their financial wealth to capital market instruments (pension plans, life insurance, investment funds, debt securities and listed shares) and less in cash and bank deposits. It also includes policy recommendations on improving retail participation in capital markets, including for the Retail Investment Strategy currently under discussion.

Some key findings include:

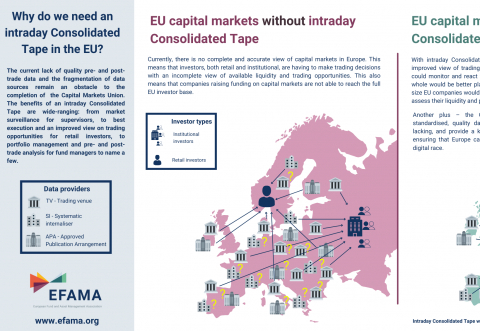

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.

Market Insights | Issue #5 | Perspective on the net performance of UCITS

Equity UCITS delivered a total net return of 108% in real terms in 2010-2019, whereas bank deposits lost 10% in net value