EFAMA agrees with the FSB that market participants should integrate the management of margin and collateral calls into their risk management, governance, and operational processes.

Management Companies

EFAMA has been looking at legislative proposals with a direct impact on asset management companies and services, and closely follows any regulatory developments of critical importance to the sector. In addition to issues related to risk management and financial stability, high up on the agenda of EFAMA members is the framework for a prudential regime for Investment Firms (IFD/R), and related implementing measures directly descending from such framework.

EFAMA is focused on minimising the impact of the rules on asset management companies, in particular those holding a limited MiFID license. Key to the sector is the need for proportionality, especially firms that are not authorised to hold client money/securities, or to deal on their own account.

FSB consultation on liquidity preparedness for margin calls in non-bank financial intermediation

Tweaking the AIFMD/UCITS Framework

EFAMA welcomes the decision of the European Commission to adopt a targeted approach in its review of the Alternative Investment Fund Management Directive (AIFMD), along with key harmonising provisions within the Undertakings for Collective Investment in Transferrable Securities Directive (UCITSD). This focus on targeted improvements recognises the role this framework has played in encouraging the growth in the European Alternative Investment Fund (AIF) market over the past decade and its resilience even throughout recent market stresses.

FATF Consultation on Recommendation 24

EFAMA welcomes the work of the FATF in reviewing and reinforcing its existing recommendations to ensure that these remain fit for purpose in tackling global financial crime.

Annual European Asset Management Report - Report highlights key developments in the European fund industry

The European Fund and Asset Management Association (EFAMA) has released the 13th edition of its Asset Management in Europe report, which provides in-depth analysis of recent trends in the European asset management industry, focussing on where investment funds and discretionary mandates are managed in Europe.

IMF 2021: Thought-provoking discussions and insightful presentations

This year’s Investment Management Forum featured an incredible number of high-level speakers and thought-provoking discussions.

.png)

AIFMD review - how to tweak a successful framework

EFAMA welcomes the European Commission’s review of the Alternative Investment Fund Management Directive (AIFMD), setting out targeted improvements to key provisions in the current framework. Such targeted improvements will make strides in advancing the Capital Markets Union. At the same time, they maintain the framework which has underpinned a decade of growth in the European Alternative Investment Fund (AIF) market and proven resilient even throughout recent market stresses.

Asset Management Report 2021

This is our 13th edition of the Asset Management in Europe report, which provides an in-depth analysis of recent trends in the European asset management industry, focussing on where investment funds and discretionary mandates are managed in Europe.

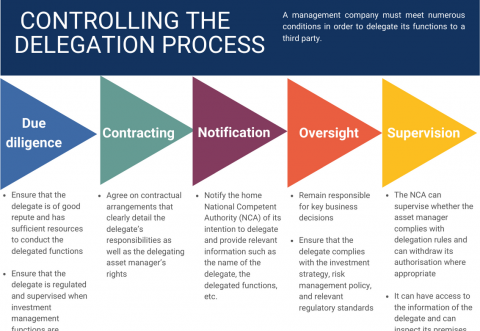

Infographic | The delegation process

The AIFMD is one of the pillars of EU regulation for investment funds, which will be crucial to the development of the Capital Markets Union (CMU) and the post Covid-19 economic recovery in the European Union. One subject that the AIFMD covers is the delegation process. We created the below infographic to shine a light on how delegation works under the current AIFMD, including how the delegation process is controlled, what activities can be delegated and what the benefits of delegation are for end investors and the asset management industry.

EFAMA Annual Review 2020-2021

It gives me great pleasure to provide you with an overview of our activities since our Ordinary General Meeting of last year.