AIFMD

The AIFMD is one of the pillars of EU regulation for investment funds, crucial to the development of the Capital Markets Union and the EU’s post-pandemic economic recovery. Since 2010 the AIFMD has set high standards of harmonisation in the alternative investment fund management sector. It currently provides a consistent regulatory approach to potential risks of the financial system, better coordinated supervision, and a high level of investor protection.

EFAMA’s priority will be to ensure low touch review of the framework, and continue facilitating exchange of information amongst members to ensure the highest standards in the application of the measures.

EFAMA Response to the EBA Consultation on draft Guidelines on outsourcing arrangements

EFAMA Position Paper Review of the European System of Financial Supervision

Use of Leverage in Investment Funds in Europe | AMIC-EFAMA Joint Paper

AIFMD review - how to tweak a successful framework

EFAMA welcomes the European Commission’s review of the Alternative Investment Fund Management Directive (AIFMD), setting out targeted improvements to key provisions in the current framework. Such targeted improvements will make strides in advancing the Capital Markets Union. At the same time, they maintain the framework which has underpinned a decade of growth in the European Alternative Investment Fund (AIF) market and proven resilient even throughout recent market stresses.

EFAMA publishes 2021 industry Fact Book - Report highlights key developments in the European fund industry in 2020

EFAMA has released its 2021 industry Fact Book.

The 2021 Fact Book provides an in-depth analysis of trends in the European fund industry, an extensive overview of the regulatory developments across 29 European countries and a wealth of data.

Monthly Statistics April 2021 | Net Inflows into long-term UCITS funds remain at a historically high level in April

EFAMA has today published its latest monthly Investment Fund Industry Fact Sheet, which provides data on UCITS, and AIFs sold in April 2021, at European level and by country of fund domiciliation.

New rules for the AIFMD and UCITS Directive

New rules for the AIFMD and UCITS Directive were published on 26 March 2024 in the Official Journal of the European Union, making them law. These investment frameworks are European success stories and an integral part of the Capital Markets Union (CMU).

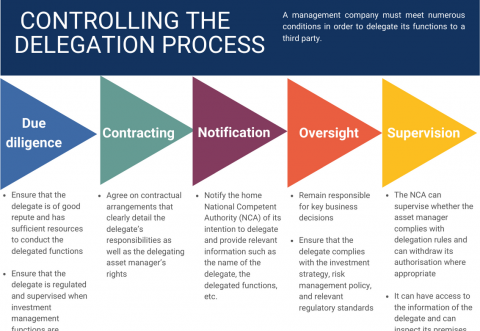

Infographic | The delegation process

The AIFMD is one of the pillars of EU regulation for investment funds, which will be crucial to the development of the Capital Markets Union (CMU) and the post Covid-19 economic recovery in the European Union. One subject that the AIFMD covers is the delegation process. We created the below infographic to shine a light on how delegation works under the current AIFMD, including how the delegation process is controlled, what activities can be delegated and what the benefits of delegation are for end investors and the asset management industry.

Asset Management in Europe - An Overview of the Asset Management Industry - November 2020

The report aims to provide a unique and comprehensive set of facts and figures on the state of the industry at the end of 2018 but also to highlight the fundamental role of asset managers in the financial system and wider economy.