We appreciate the opportunity to respond to this important consultation and remain gladly at the disposal of the European Commission staff to elaborate on any of our responses.

Capital markets

Investment managers, acting on behalf of their retail and institutional clients, are among the largest investors in financial markets. They represent a key component of the market’s “buy-side” segment.

In representing the interests of its members on wholesale capital market issues, EFAMA advocates for fair, deep, liquid, and transparent capital markets, supported by properly regulated and supervised market infrastructure.

EFAMA Position on the draft Joint Guidelines of ESAs regarding customer due diligence under Anti-Money Laundering Directive

EFAMA is closely monitoring the recent regulatory developments in the field of anti-money laundering and counter-terrorist financing, in particular the due diligence duties of the asset management sector. EFAMA is embracing the objective of enhancing transparency and accessibility to the beneficial ownership information and also fully acknowledges the importance of obtaining accurate identification and verification data of natural and legal persons for fighting money laundering and terrorist financing.

EFAMA's reply to ESMA's CP on RTS specifying the scope of the consolidated tape for non-equity financial instruments

EFAMA supports every efforts made to enhance financial markets regulation which reinforces the stability and the transparency of the financial system.

In that perspective, EFAMA welcomes the opportunity to comment on the ESMA Consultation Paper on RTS specifying the scope of the consolidated tape for non-equity financial instruments. We consider that a consolidate tape (“CT”) is a key positive factor for price formation and transparency.

Prior to replying to the consultation, we wish to make the following general remarks

Buy-side experts worried that mandatory active accounts for EU clearing could increase systemic risks, not lower them

EFAMA is pleased to share the link to the educational webinar it organised on 14 June with leading buy-side clearing experts, including Allianz Global Investors, Aviva Investors, BlackRock and Nordea Asset Management, to discuss the main findings of EFAMA's recent analysis on mandated active accounts for EU clearing.

Policymakers threaten to backtrack on pre-trade data for EU consolidated tape

European asset managers continue to urge policymakers to support the European Parliament’s proposal for an Equities/ETFs consolidated tape which includes 5 layers of real-time pre-trade data. Market participants, including the European buy and sell-sides have consistently maintained that a post-trade only equities/ETFs consolidated tape will not meet with the market demand required to make the tape commercially viable. Tanguy van de Werve, Director General of EFAMA, stated: “This would be a legislative se

EFAMA statement on European exchanges’ bid to run a consolidated equities tape

EFAMA welcomes the recent proposal by European exchanges to build a consolidated tape. This affirms the buy-side’s long standing view that a European consolidated tape is key to completing the objectives of the Capital Markets Union and ensuring that European capital markets remain globally competitive. We have identified important use-cases for institutional and retail investors alike, not least in the ability to receive best execution on trades.

Household Participation in Capital Markets

This report analyses the progress made in recent years by European households in allocating more of their financial wealth to capital market instruments (pension plans, life insurance, investment funds, debt securities and listed shares) and less in cash and bank deposits. It also includes policy recommendations on improving retail participation in capital markets, including for the Retail Investment Strategy currently under discussion.

Some key findings include:

Buy-side use-cases for a real-time consolidated tape

A real-time consolidated tape, provided it is made available at a reasonable cost, will bring many benefits to European capital markets. A complete and consistent view of market-wide prices and trading volumes is necessary for any market, though this is especially true for the EU where trading is fragmented across a large number of trading venues. A real-time consolidated tape should cover equities and bonds, delivering data in ‘as close to real-time as technically possible’ after receipt of the data from the different trade venues.

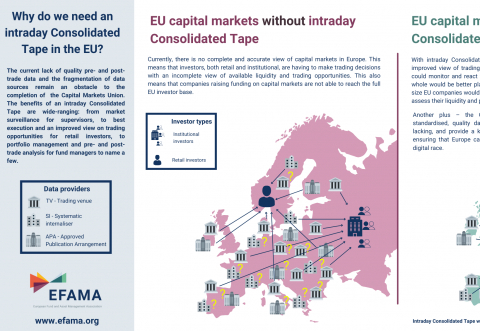

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.