MiFID / MiFIR

The Markets in Financial Instruments Directive (MiFID) is a cornerstone of EU financial services legislation and is of direct relevance to asset management companies. In 2014, the European Commission adopted new rules revising MiFID, consisting of a Directive (MiFID II) and a regulation (MiFIR). Overall, MiFID II yielded positive results in terms of liquidity and transparency for investors.

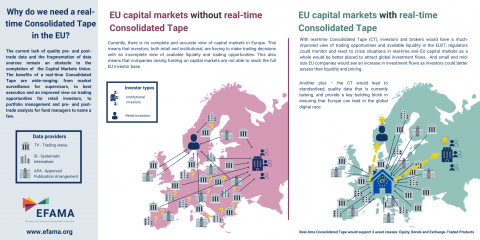

Among possible improvements to the MiFID framework, EFAMA encourages the creation of a well-structured, reasonably priced consolidated tape managed by ESMA and fed by all trading venues and systematic internalisers for all financial instruments. A second, long-term EFAMA objective is better enforcement of data providers’ existing obligation to provide market data on a “reasonable commercial basis”.

EFAMA’s response to ESMA’s CP on data costs and consolidated tape

EFAMA's response to ESMA's CfE on the impact of the inducements & costs and charges disclosure requirements under MiFID II

EFAMA & EFSA joint letter on FCA wholesale market data study

The FCA’s recent report on the wholesale data market is an important and high-quality study which echoes many long-standing buy-side concerns. It finds evidence of unequal market power in terms of market concentration, highly profitable margins, opaque pricing practices, excessive charging, bundling practices and complex licensing agreements, all of which negatively impact data users. Much of this data is indispensable for users to stay in business and fulfil regulatory obligations.

New rules establishing EU consolidated tape will boost capital markets, but could still go further

Today’s European Parliament vote concludes the MiFID/R review process

Joint trade associations urge policymakers not to concede to suboptimal outcomes in MiFIR review

EU asset managers, banks and brokers are today urging policy makers not to concede to pressure which will lead to suboptimal outcomes in the review of the Markets in Financial Instruments Directive (MiFID/R).

3 Questions to Rudolf Siebel on Market Data Costs

Q #1 Have you witnessed an increase in the cost of market data over the last couple of years? If so, how can it be explained?