Management Companies

EFAMA has been looking at legislative proposals with a direct impact on asset management companies and services, and closely follows any regulatory developments of critical importance to the sector. In addition to issues related to risk management and financial stability, high up on the agenda of EFAMA members is the framework for a prudential regime for Investment Firms (IFD/R), and related implementing measures directly descending from such framework.

EFAMA is focused on minimising the impact of the rules on asset management companies, in particular those holding a limited MiFID license. Key to the sector is the need for proportionality, especially firms that are not authorised to hold client money/securities, or to deal on their own account.

EFAMA's comments on the European Commission consultation on the review of the EuVECA & EuSEF Regulations

EFAMA Reply to 2nd consultation on NBNI G-SIFIs

EFAMA and its Members appreciate the opportunity to comment on the second FSB/IOSCO consultative document in the context of the current global debate around the alleged “systemic” nature of the asset management industry. EFAMA is the representative association for the European investment management industry. We represent through our 26 national association members, 63 corporate members and 25 associate members about EUR 17 trillion in assets under management, of which EUR 11.3 trillion managed by 55,600 investment funds at end‐December 2014.

Monthly Statistics September 2020 | Steady inflows into UCITS equity funds in September

The European Fund and Asset Management Association (EFAMA) has today published its latest monthly Investment Fund Industry Fact Sheet, which provides net sales data of UCITS and AIFs for September 2020*.

Bernard Delbecque, Senior Director for Economics and Research commented: Net inflows into UCITS equity funds remained steady in September despite concerns about rising Covid-19 infection rates and the potential impact of new lockdown measures.

The main developments in September 2020 can be summarised as follows:

Initial reactions on the new Capital Markets Union action plan - Keynote by Tanguy van de Werve

6th Cyprus International Funds Summit - 16 November 2020

Monthly Statistics August 2020 | UCITS and AIFs continue to record net inflows in August

The European Fund and Asset Management Association (EFAMA) has today published its latest monthly Investment Fund Industry Fact Sheet, which provides net sales data of UCITS and AIFs for August 2020*.

Bernard Delbecque, Senior Director for Economics and Research commented: "Thanks to positive news on the global economic recovery, long-term UCITS continued to record net inflows in August, albeit at a slower pace than during the previous four months."

Asset Management Report 2021

This is our 13th edition of the Asset Management in Europe report, which provides an in-depth analysis of recent trends in the European asset management industry, focussing on where investment funds and discretionary mandates are managed in Europe.

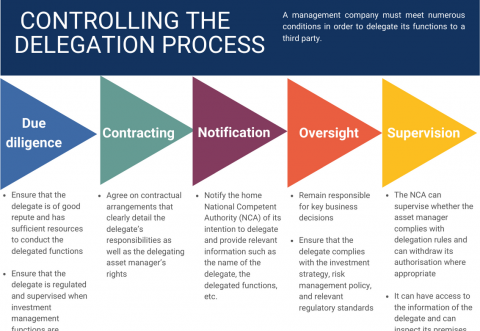

Infographic | The delegation process

The AIFMD is one of the pillars of EU regulation for investment funds, which will be crucial to the development of the Capital Markets Union (CMU) and the post Covid-19 economic recovery in the European Union. One subject that the AIFMD covers is the delegation process. We created the below infographic to shine a light on how delegation works under the current AIFMD, including how the delegation process is controlled, what activities can be delegated and what the benefits of delegation are for end investors and the asset management industry.

EFAMA Annual Review 2020-2021

It gives me great pleasure to provide you with an overview of our activities since our Ordinary General Meeting of last year.