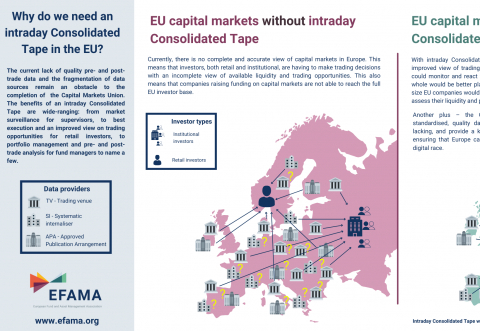

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.