Press Release - For immediate release

EFAMA publishes the 17th Edition of its Fact Book, the sole comprehensive record of European investment trends over the past decade

Brussels, 3rd July 2019 - EFAMA, the voice of the European investment management industry, today publishes the 17th edition of its Fact Book. This years edition includes an in-depth analysis of recent developments in the European investment fund industry, including new data on the sales of domestic and cross-border funds and the share of domestic funds held abroad, across 29 European countries.

EFAMAs Director General Tanguy van de Werve comments: The goal of the Fact Book remains the same since the first edition, i.e. to provide all stakeholders in our industry fund management companies, asset servicers, investors, the official sector, think tanks and academics with relevant information on the state of the European investment industry. Two specific highlights emerge from this years analysis: the sustained level of net sales of UCITS and AIFs, even under challenging market conditions, and the depth of the Single Market as illustrated by the growth of cross-border funds sold within and outside Europe.

I am convinced that the outlook for our industry is favorable. Provided the right framework and incentives are in place, the European investment fund industry can play an important role in supporting sustainable economic growth, holding investee companies to account, providing long-term financing and helping citizens meet their future liabilities.

The main highlights on key developments in 2018 and over the past decade are the following:

- Net sales of UCITS and AIFs remained positive in 2018 despite stock volatility and investor nervousness.

2018 proved a challenging year for the investment fund industry. Political uncertainty in Europe, the US global trade war, monetary policy tightening and concerns over economic growth led to a sharp drop in net sales compared with 2017. Despite this, both UCITS and AIFs continued to record positive net sales in 2018, confirming that investment funds remain attractive investment products even at times of market turbulence.

- Net assets of European investment funds declined by 3% in 2018, primarily a result of the steep fall in world stock markets at the end of the year.

The drop in the stock markets led to the first decline in the net assets of UCITS and AIFs since 2011; UCITS declined by 5% in 2018, whereas AIFs dropped 0.5%. Despite this setback, the overall growth of the industry in the last 10 years has been impressive, with total net asset of UCITS and AIFs increasing by 140% since 2008.

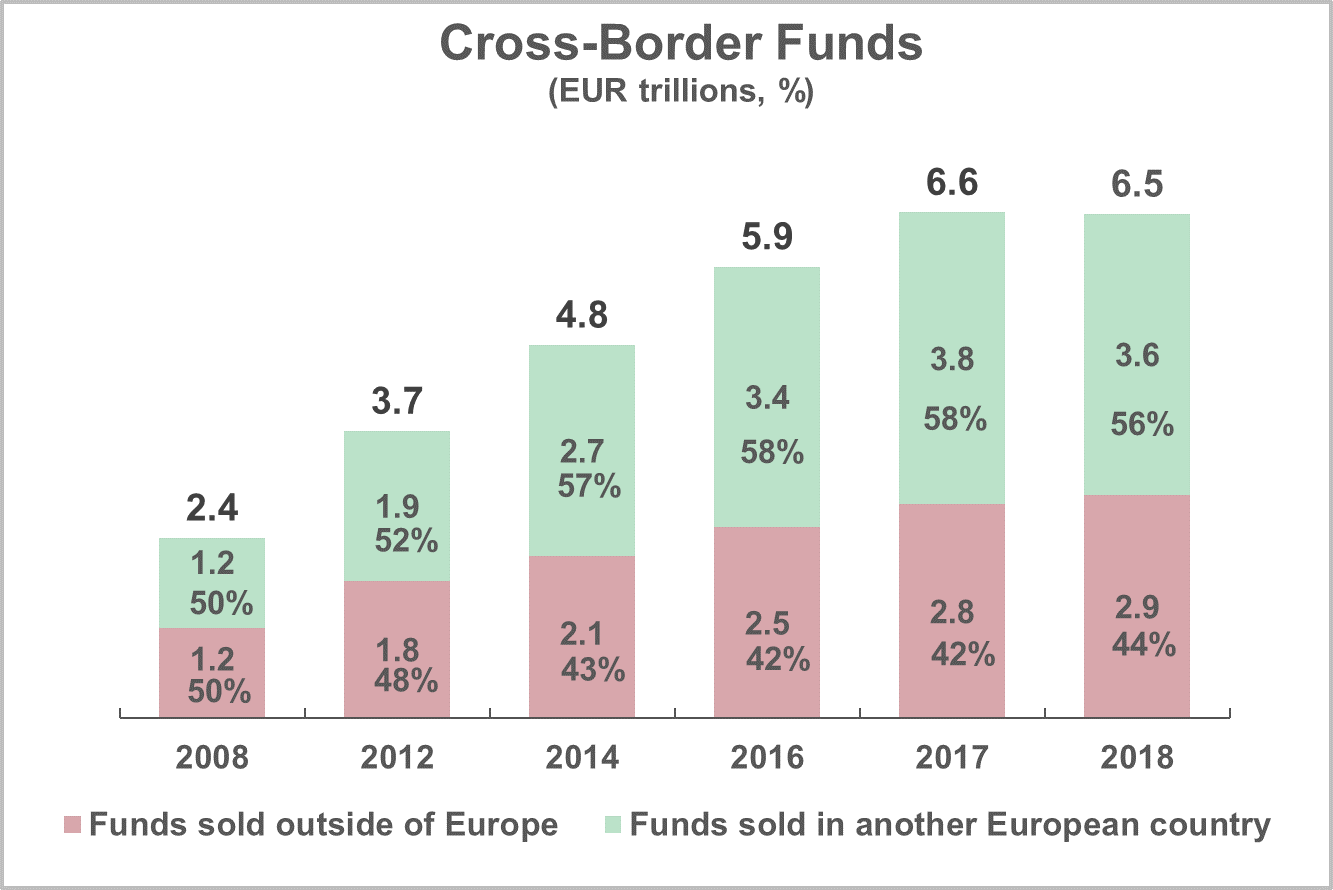

- Passports allow home-domiciled European funds to also be sold to investors abroad at both the European and international levels.

The size of the European cross-border investment fund market has grown strongly, from EUR 2.4 trillion, or 40% of total net assets of European funds in 2008, to EUR 6.5 trillion, or 46% of the total fund market in 2018. This growth can be mostly attributed to the increase in cross-border funds sold in other European countries, highlighting the dynamism of the Single Market for investment funds.

Ends

About the EFAMA Fact Book:

This years edition includes:

| An in-depth analysis of recent developments in the European investment fund industry, including new data on the sales of domestic and cross-border funds and the share of domestic funds held abroad.

|

For the first time, the Fact Book is also available in PDF format. In addition, all Fact Book purchasers receive a complimentary statistical package in Excel, containing a set of 30 tables with historical time series on net assets and number of UCITS and AIFs at the country level.

EFAMAs Fact Book can be ordered here.

For media enquiries, please contact:

Tanguy van de Werve, Director General ,

Bernard Delbecque, Director for Economics and Research

Telephone: +32 (0) 2 513 39 69;

E-mail: info@efama.org

Notes to editors:

About the European Fund and Asset Management Association (EFAMA):

EFAMA, the Brussels-based European Fund and Asset Management Association, is the voice of the European investment management industry. Its membership consists of 28 national associations and 60 corporate members. At end 2018, total net assets of European investment funds reached EUR 15.2 trillion. These assets were managed by close to 33,400 UCITS (Undertakings for Collective Investments in Transferable Securities) and 28,600 AIFs (Alternative Investment Funds). More information available at www.efama.org.