Today, EFAMA has published our latest Monthly Statistical Release for February 2024.

Thomas Tilley, Senior Economist at EFAMA, commented: “February 2024 saw net sales of long-term UCITS rise to a 12-month peak thanks to robust net inflows into bond funds and equity ETFs. This continues the 2023 trends, with investors responding to interest rate evolutions in the case of bond funds, and the enduring popularity of ETFs resulting in sustained equity ETFs inflows.”

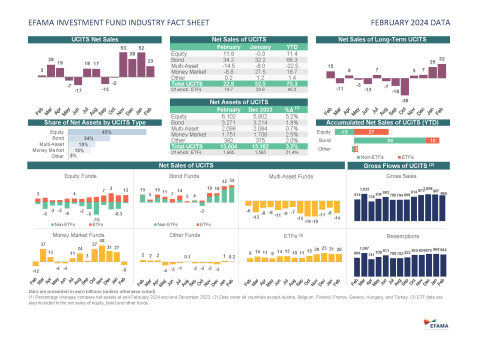

The main developments in Februarycan be summarised as follows:

UCITS and AIFs recorded net inflows of EUR 21bn, down from EUR 61bn in January.

UCITS attracted net inflows of EUR 23bn, compared to EUR 52bn in January.

- Long-term UCITS (UCITS excluding money market funds) saw net inflows of EUR 32bn, up from EUR 25bn in January.

- Equity funds registered net inflows of EUR 12bn, compared to net outflows close to zero in January.

- Bond funds experienced net inflows of EUR 34bn, up from EUR 32bn in January.

- Multi-asset funds continued to suffer from net outflows (EUR 14bn), compared to EUR 8bn in January.

- UCITS money market funds experienced net outflows of EUR 9bn, compared to net inflows of EUR 27bn in January.

UCITS ETFs recorded inflows of EUR 20bn, similar to the level observed in January.

- Long-term UCITS (UCITS excluding money market funds) saw net inflows of EUR 32bn, up from EUR 25bn in January.

AIFs recorded net outflows of EUR 2bn, compared to net inflows of EUR 9bn in January.

Total net assets of UCITS and AIFs increased by 1.25%, to EUR 21.2 trillion.

-ENDS-

Notes to editors

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of communication & membership development

Tel: +32 2 513 39 69

Email: info@efama.org