EFAMA has published its latest Monthly Statistical Release for September 2024.

Bernard Delbecque, Senior Director for Economics and Research at EFAMA, commented: “September witnessed notable outflows from long-term UCITS in some countries, largely driven by rising uncertainties surrounding the interest rate cycle, the upcoming U.S. Presidential election, and the fiscal measures being implemented to address budget deficits in several countries.”

The main developments in September can be summarised as follows:

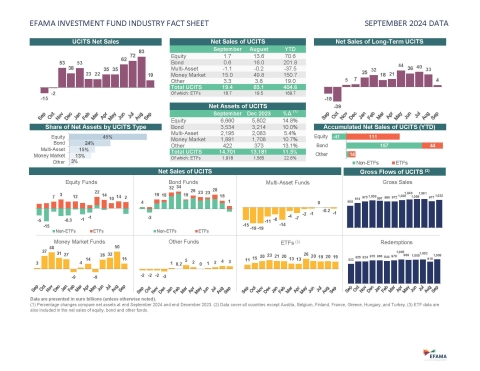

UCITS and AIFs recorded net inflows of EUR 19bn, a significant decline from EUR 82bn in August.

UCITS attracted net inflows of EUR 19bn, down from EUR 83bn in August.

Long-term UCITS (UCITS excluding money market funds) saw net inflows of EUR 4bn, a decrease from EUR 33bn in August. Of these, ETF UCITS attracted net inflows of EUR 19bn, slightly down from EUR 20bn in August.

- Equity UCITS registered net inflows of EUR 2bn, a decline from EUR 14bn in August.

- Bond UCITS recorded net inflows of EUR 1bn, down from EUR 16bn in August.

- Multi-asset UCITS experienced net outflows of EUR 1bn, compared to EUR 0.2bn in August.

Money Market (MMF) UCITS attracted net inflows of EUR 15bn, down from EUR 50bn in August.

- AIFs recorded net outflows of EUR 0.2bn, compared to EUR 1bn in August.

- Total net assets of UCITS and AIFs grew by 1%, reaching EUR 22,723bn.

-ENDS-

Notes to editors

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of communication & membership development