For immediate release

Strong Rebound in UCITS and AIF Net Assets and Net Sales in first quarter 2019

Brussels, 4th June 2019 - The European Fund and Asset Management Association (EFAMA) has today published its Quarterly Statistical Release describing the trends in the European investment fund industry in the first quarter of 2019 with key data and indicators for each EFAMA member countries.

The first quarter of 2019 was marked by three major developments in the European investment fund industry:

The first quarter of 2019 was marked by three major developments in the European investment fund industry:

- A strong increase in net assets of UCITS and AIF, driven by the rebound of financial markets:

- Net assets of UCITS increased by 7.8% to EUR 10,004 billion;

- Net assets of AIFs increased by 6.4% to EUR 6,247 billion.

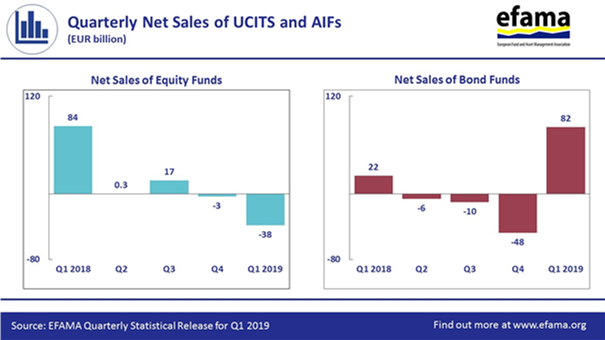

- A sharp increase in the demand for bond funds in response to a move towards more dovish monetary policy in Europe and the United States:

- Net sales of UCITS and AIF bond funds sales turned positive in Q1 2019, with net inflows of EUR 82 billion, compared to net outflows of EUR 48 billion in Q4 2018.

- Net sales of UCITS bond funds recorded net inflows of EUR 79 billion, compared to net outflows of EUR 46 billion in Q4 2018;

- AIF bond funds saw a reversal in flows, from net outflows of EUR 2 billion in Q4 2018 to net inflows of EUR 3 billion in Q1 2019.

- A downward trend in net sales of equity funds in face of weaker economic growth:

- Net sales of UCITS and AIF equity funds recorded net outflows of EUR 38 billion, compared to net inflows of EUR 3 billion in Q4 2018.

- UCITS equity funds recorded net outflows of EUR 27 billion, compared to net outflows of EUR 7 billion in Q4 2018;

- AIF equity funds registered net outflows of EUR 11 billion, compared to net inflows of 4 billion in Q4 2018.

Bernard Delbecque, Senior Director for Economics and Research commented: After the challenges the industry faced in 2018, and coming off net outflows in Q4, the sales we have seen in Q1 represented a positive development for the industry. However, the net outflows from equity funds confirmed that investor confidence in equity markets has yet to return.

Ends

*Please see the  accompanying attachment for the EFAMA Quarterly Statistical Release (Q1 2019) and the Notes to editors section for further information on how the Statistical Release is produced.

accompanying attachment for the EFAMA Quarterly Statistical Release (Q1 2019) and the Notes to editors section for further information on how the Statistical Release is produced.

accompanying attachment for the EFAMA Quarterly Statistical Release (Q1 2019) and the Notes to editors section for further information on how the Statistical Release is produced.

accompanying attachment for the EFAMA Quarterly Statistical Release (Q1 2019) and the Notes to editors section for further information on how the Statistical Release is produced.For media enquiries, please contact:

Tanguy van de Werve, Director General

Bernard Delbecque, Senior Director for Economics and Research

Telephone: +32 (0) 2 513 39 69

E-mail: info@efama.org

Notes to editors:

About the European Fund and Asset Management Association (EFAMA):

EFAMA is the representative association for the European investment management industry, which represents 28 member associations and 62 corporate members. At end 2018, total net assets of European investment funds reached EUR 15.2 trillion. Close to 33,400 of these funds were UCITS (Undertakings for Collective Investments in Transferable Securities) and close to 28,600 of these funds were AIFs (Alternative Investment Funds). For more information about EFAMA, please visit www.efama.org