EFAMA has published the latest Monthly Statistical Release for April 2024.

Thomas Tilley, Senior Economist at EFAMA, commented: “Despite a dip in global stock markets, bond UCITS continued to attract strong net inflows in April as investors were anticipating the June ECB rate cut.”

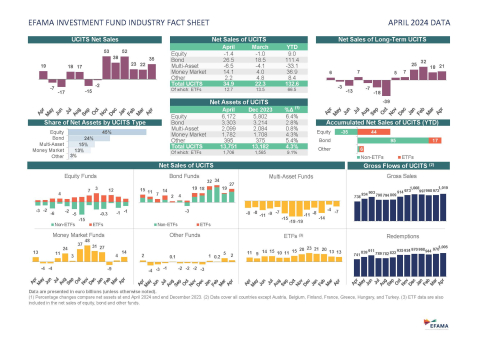

The main developments in April can be summarised as follows:

- UCITS and AIFs recorded net inflows of EUR 42bn, up from EUR 24bn in March.

UCITS attracted net inflows of EUR 35bn, compared to EUR 22bn in March.

- Long-term UCITS (UCITS excluding money market funds) saw net inflows of EUR 21bn, up from EUR 18bn in March.

- Equity funds registered net outflows of EUR 1bn, similar to the level of net outflows in March.

- Bond funds experienced net inflows of EUR 27bn, up from EUR 19bn in March.

- Multi-asset funds continued to suffer from net outflows (EUR 7bn), compared to net outflows of EUR 4bn in March.

UCITS money market funds experienced net inflows of EUR 14bn, compared to EUR 4bn in March.

- UCITS ETFs recorded net inflows of EUR 13bn, similar to the inflows in March.

- Long-term UCITS (UCITS excluding money market funds) saw net inflows of EUR 21bn, up from EUR 18bn in March.

AIFs recorded net inflows of EUR 7bn, compared to EUR 2bn in March.

Total net assets of UCITS and AIFs decreased by 0.7%, to EUR 21,466bn.

-ENDS-

Notes to editors

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of communication & membership development

Tel: +32 2 513 39 69

Email: info@efama.org