Benchmarks

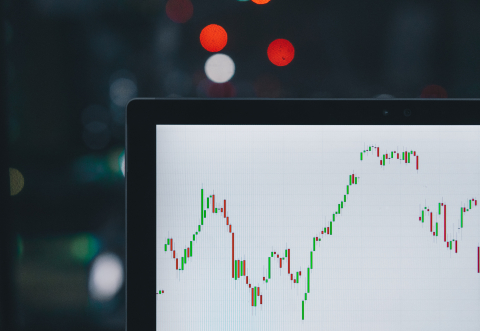

Asset managers use financial indices and benchmarks when managing portfolios on behalf of their clients. Integrity and accuracy of benchmarks and indices are critical to the pricing of many financial instruments, and therefore play an important role in building confidence in the market and its reflection of the real economy.

EFAMA believes that a balanced and proportionate regulatory framework is needed to efficiently deal with benchmarking risks (such as manipulation and conflicts of interest), without unjustifiably hampering investment opportunities or increasing burden and costs for end-investors.

EFAMA response to EUR RFR WG 3rd consultation on EONIA to ESTER legal action plan

EFAMA response to the questions of EUR RFR WG report on the transition from EONIA to ESTER

A rushed deal on the Benchmarks Regulation would jeopardise transparency, with negative impacts for the sustainable finance framework

EFAMA members are concerned that revisions to the Benchmark Regulation, which is due to be voted in the European Parliament’s ECON committee next week, will harm the EU sustainable finance regime and create gaps in transparency more broadly.

3 Questions to Jean-Louis Schirmann on the use of EURIBOR

Q #1 How was Euribor impacted by the adoption of the Benchmark Regulation (BMR) and what are the relevant features of the reformed Euribor for investment managers?

3 Questions to Christophe Binet on LIBOR Transition

Q #1 When will LIBOR phase out and which rates will be replacing it?

The London Interbank Offered Rate, also known as LIBOR®, is a widely-used index for short-term interest rates that is commonly found in

Closet Index Funds

EFAMA has reviewed ESMA’s statement “Supervisory work on potential index tracking”, which sets out research to determine whether any indication of closet indexing could be found at EU level. To contribute to the debate on this matter, EFAMA has prepared a paper, which highlights the limits of identifying closet index funds through a statistical analysis, drawing on recently published research papers.