Management Companies

EFAMA has been looking at legislative proposals with a direct impact on asset management companies and services, and closely follows any regulatory developments of critical importance to the sector. In addition to issues related to risk management and financial stability, high up on the agenda of EFAMA members is the framework for a prudential regime for Investment Firms (IFD/R), and related implementing measures directly descending from such framework.

EFAMA is focused on minimising the impact of the rules on asset management companies, in particular those holding a limited MiFID license. Key to the sector is the need for proportionality, especially firms that are not authorised to hold client money/securities, or to deal on their own account.

EFAMA reply to ECB's Flash survey on operation of Post Trade Servides during the Covid-19 pandemic

Industry Association Letter on Impact of COVID-19 on Initial Margin Phase-In

Coalition letter on keeping European markets open

EU retail investments: comprehensive strategy to increase retail investor participation required

EFAMA wholeheartedly supports a retail investment strategy that gives EU citizens the necessary tools and the confidence to put their savings to work by investing in capital markets.

EFAMA publishes 2021 industry Fact Book - Report highlights key developments in the European fund industry in 2020

EFAMA has released its 2021 industry Fact Book.

The 2021 Fact Book provides an in-depth analysis of trends in the European fund industry, an extensive overview of the regulatory developments across 29 European countries and a wealth of data.

Naïm Abou-Jaoudé, CEO of CANDRIAM, elected new President of EFAMA - EFAMA appoints new Board of Directors

On the occasion of its annual meeting held on Friday 11 June, EFAMA’s General Meeting (GM) elected Naïm Abou-Jaoudé, CEO of CANDRIAM, as President for a two-year term, running until June 2023.

Asset Management Report 2021

This is our 13th edition of the Asset Management in Europe report, which provides an in-depth analysis of recent trends in the European asset management industry, focussing on where investment funds and discretionary mandates are managed in Europe.

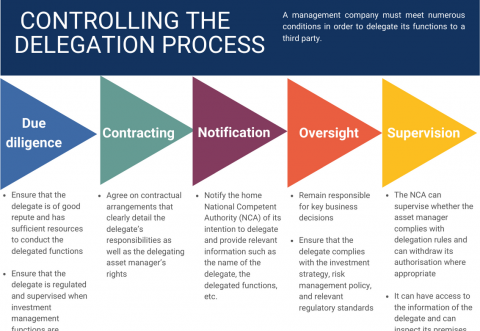

Infographic | The delegation process

The AIFMD is one of the pillars of EU regulation for investment funds, which will be crucial to the development of the Capital Markets Union (CMU) and the post Covid-19 economic recovery in the European Union. One subject that the AIFMD covers is the delegation process. We created the below infographic to shine a light on how delegation works under the current AIFMD, including how the delegation process is controlled, what activities can be delegated and what the benefits of delegation are for end investors and the asset management industry.

EFAMA Annual Review 2020-2021

It gives me great pleasure to provide you with an overview of our activities since our Ordinary General Meeting of last year.