EU Taxonomy Regulation

The Taxonomy is a critical tool that will assist issuers, project promoters, investors and other financial market participants in identifying sustainable, enabling and transitional economic activities. The regulation requires asset managers to disclose the proportions of their Taxonomy-compliant “green asset ratios” in funds with sustainability objectives and characteristics.

Asset managers will rely upon investee companies’ reporting against the technical screening criteria introduced by the Taxonomy. Given that these criteria will be fundamental in guiding the investment decisions of asset managers and, increasingly so, of public authorities, they should allow for a sufficiently broad investible universe, including transitional activities. EFAMA has also contributed to the development of industry-relevant Taxonomy Key Performance Indicators for financial and non-financial undertakings.

EFAMA's position on EU Taxonomy in view of Trialogues

EFAMA comments European Commission's Taxonomy Proposal (Sustainable Finance Package)

European single access point for data? EFAMA’s 6 key recommendations

The European Fund and Asset Management Association (EFAMA) has published its response to the European Commission's consultation on the establishment of a European Single Access Point (ESAP) for financial and non-financial information publicly disclosed by companies.

ESG investing in the UCITS market: a powerful and inexorable trend

The European Fund and Asset Management Association (EFAMA) has published its latest Market Insights report titled “ESG Investing in the UCITS Market – A powerful and inexorable trend”. The report looks at the major trends in the ESG UCITS market, the impact of the coronavirus pandemic, and the behaviour of ESG and non-ESG funds.

EU Taxonomy at risk of hampering green housing investments

|

As the voice of the European asset management industry, EFAMA strongly welcomes the development of the EU Taxonomy and its proposed technical screening criteria in the Delegated Acts. EFAMA sees the Taxonomy as a critical tool to unleash the potential of sustainable finance in Europe by assisting issuers, project promoters, companies, investors, and other financial market participants in identifying truly sustainable economic activities. |

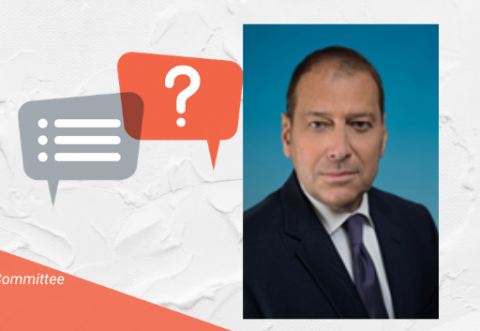

3 questions to Thierry Bogaty on the EU Ecolabel for retail financial products

Q #1 Can the EU Ecolabel for retail financial products help channel individual investors’ savings into environmentally sustainable projects?

A well-designed EU Ecolabel has the potential to provide clear guidance on the financial products retail investors can invest in if they wish to support environmentally sustainable projects and activities - in line with the EU Taxonomy Regulation. The European Commission wants to create a trusted and verified label for retail investors, who would benefit from better comparability of financial products.