MiFID / MiFIR

The Markets in Financial Instruments Directive (MiFID) is a cornerstone of EU financial services legislation and is of direct relevance to asset management companies. In 2014, the European Commission adopted new rules revising MiFID, consisting of a Directive (MiFID II) and a regulation (MiFIR). Overall, MiFID II yielded positive results in terms of liquidity and transparency for investors.

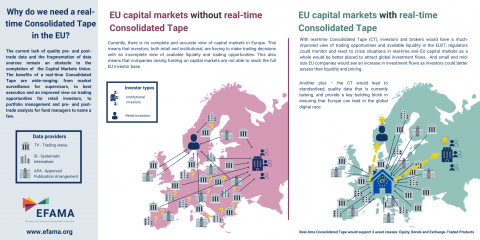

Among possible improvements to the MiFID framework, EFAMA encourages the creation of a well-structured, reasonably priced consolidated tape managed by ESMA and fed by all trading venues and systematic internalisers for all financial instruments. A second, long-term EFAMA objective is better enforcement of data providers’ existing obligation to provide market data on a “reasonable commercial basis”.

EFAMA Reply: ESMA CP on review report MiFIR transparency regime for equity, ETFs & other related instruments

Joint Statement on Market Data Costs

Reasonable Market Data Costs Benefits the Real Economy

The fundamental function of a trading venue is to match buyers and sellers of securities at a price that balances supply and demand through transparent rules and processes. The sale of market data is a related but separate by-product of that primary function.

MiFIDII/ MiFIR review - EFAMA-BVI-EFSA-NSA priorities

The MiFID/MiFIR review will be key to the future success and competitiveness of the EU's capital markets.

With international competition for investment heating up markedly, European legislators need to ensure that EU regulation is helping, and not hindering, capital market growth and participation.

Various European trade associations representing EU capital markets, including EFAMA, BVI, EFSA and NSA, have published a letter outlining their main priorities for the review. This includes the following core elements:

The availability of a real-time consolidated tape in Europe is critical for the success of the CMU

EFAMA members are paying close attention to the ongoing discussions in the European Parliament and Council to reach a compromise on the MiFID review. Together with a broad majority of market participants, including the sell-side and alternative trading venues, we have consistently made the case for a real-time tape for equities with the inclusion of pre and post-trade data.

EFAMA responses to the discussion questions within the IOSCO report “corporate bond markets – drivers of liquidity during covid-19 induced market stresses”

EFAMA is appreciative of the opportunity to comment on this major IOSCO study on the dynamics of bond market liquidity during market stresses. We provide some detailed responses below, but would reiterate a few high-level points here: