The European Commission’s proposal on MiFIR establishes the blueprint for a consolidated tape (CT) for Europe’s capital markets. It also significantly alters the competitive market structure brought about by MiFID II by introducing greater transparency requirements. Finally, it addresses important issues around market data costs.

Capital markets

Investment managers, acting on behalf of their retail and institutional clients, are among the largest investors in financial markets. They represent a key component of the market’s “buy-side” segment.

In representing the interests of its members on wholesale capital market issues, EFAMA advocates for fair, deep, liquid, and transparent capital markets, supported by properly regulated and supervised market infrastructure.

EFAMA position MiFIR review - a buy-side view on consolidated and market structure reforms

IOSCO Consultation on 'Review of margining practices'

We commend the work that IOSCO has undertaken to date on this topic including the survey work and the summary findings in the form of the report currently under review. It is fair to say that the conclusions of the report and areas for further work gave rise to detailed discussions within our industry, yielding ultimately firm views on the priority areas that we support and see value in, and areas we felt were not reflected in the study and thereby building risk into margining models in future crisis scenarios. These areas are fur

ESMA consultation on the review of clearing thresholds under EMIR

For asset managers the main issue continues to be the reclassification of ETDs as OTCs as a result of the non-equivalence of UK regulated markets. While we understand that a review is legally mandated at this point in time, we do not see value in recalibrating the various thresholds or making changes to the calculation methodologies unless these are in the two areas we define below. Our main concern revolves around the fact that changes would carry significant compliance costs while making little impact on the population of counterparties and notional captured by the thresholds.

Statement on the release of the Oliver Wyman study ‘Caught on Tape’

“Oliver Wyman’s study ‘Caught on Tape’ provides a perplexing take on Consolidated Tape for Europe. Sure enough, it starts with accurate observations: the high number of trading venues in Europe, the resultant fragmented liquidity, unseen liquidity due to the lack of a consolidated tape, and the fact that leading markets like the US and Canada today benefit from a real time consolidated tape.

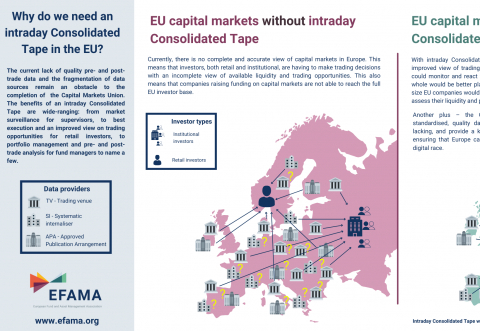

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.

UK clearing house equivalence - request from nine trade associations

Nine associations (AFME, AIMA, EAPB, EBF, EFAMA, FIA, ICI, ISDA, SIFMA AMG) welcome the Commission's decision to grant a time-limited equivalence decision in respect of UK CCPs. However, when this time-limited equivalence decision expires on 30 June 2022, there remains a significant risk of disruption to clearing for EU firms and to their access to global markets.

3 questions to Agathi Pafili on CSDR

Q #1 What is the CSDR’s Settlement Discipline Regime (SDR) and what does it seek to achieve?

Asset Management in Europe - An Overview of the Asset Management Industry - November 2020

The report aims to provide a unique and comprehensive set of facts and figures on the state of the industry at the end of 2018 but also to highlight the fundamental role of asset managers in the financial system and wider economy.

Annual Review June 2019-June 2020

"It gives me great pleasure to provide you with an overview of our activities since our Annual General Meeting in Paris last year. While we were very much looking forward to hosting you all in Brussels this week, the current crisis and associated travel restrictions has forced us to improvise and turn our meeting into a virtual AGM.