Through its ETF Task Force, EFAMA has produced an Investor Education Guide intended to draw out, in a simple form, the defining features for the three main types of ETPs (Exchange-traded products) listed across European markets. The association hopes this guide will primarily assist investors in having a clearer understanding of different ETPs and help investors appreciate the differences between them, especially from a risk and product complexity viewpoint. Secondly, the guide could be valuable to other interested stakeholders, including other market participants, policy-makers and financial

media.

Federico Cupelli, Senior Regulatory Affairs Adviser at EFAMA, commented: "We believe that a greater understanding around different types of ETPs is needed. This is prompted by the all too frequent confusion between these products, as witnessed again earlier this year during the Covid-19-induced market corrections, as well as by retail investors growing interest in these products."

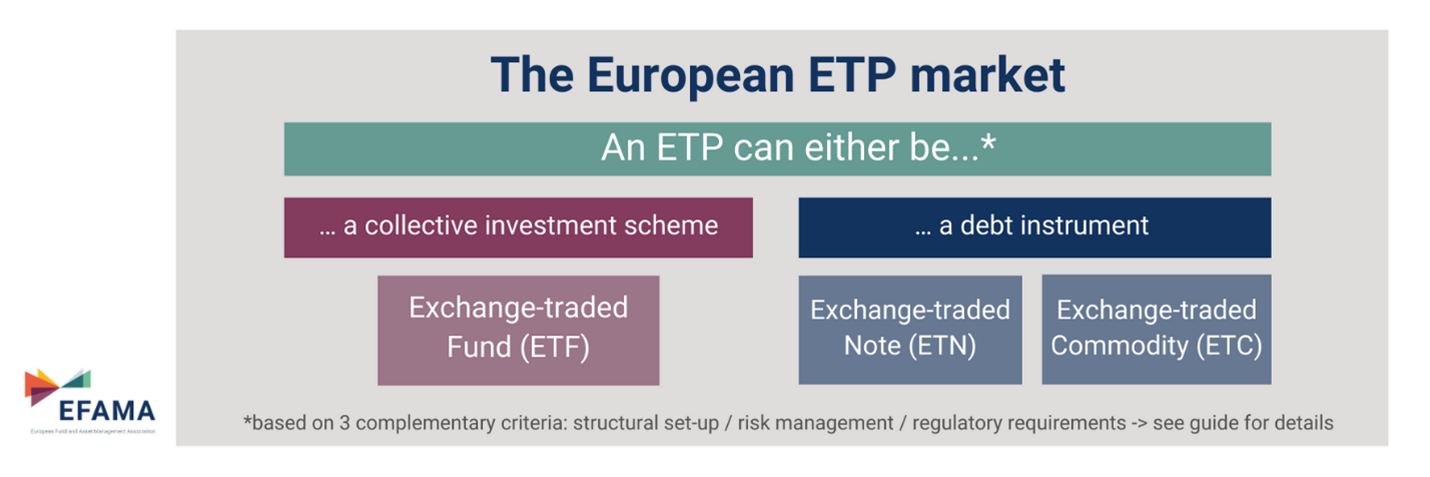

Exchange-traded products (ETPs) is the umbrella term used to refer to investment products that are traded on an exchange, unlike traditional mutual funds. ETPs will often track an underlying asset, such as a stock, an index, a commodity, etc. but can also be actively managed.

Over the course of the last decade, ETPs have witnessed a spectacular growth, as they continue to draw assets both in Europe and globally. The lions share of this growth can be attributed to exchange-traded funds (ETFs),undoubtedly the most popular among ETPs, but there are other types of ETPs. This includes exchange-traded notes (ETNs) and exchange-traded commodities(ETCs). Although these trade on an exchange like ETFs, there are considerable differences between these products, in terms of structural set-up, risk management and applicable EU regulatory requirements.

EFAMAs simple descriptions remain broad and are not intended to provide advice on which product types are suitable for which investors. As ever with investing, individual circumstances and features of any proposed investment must be considered, alongside professional advice where necessary, before making any investment decision.

-- ENDS

Formedia enquiries, please contact:

Hume Brophy

Kerri Anne Rice kerrianne.rice@humebrophy.com

PaulAndrieu paul.andrieu@humebrophy.com

EFAMA

Daniela Haiduc Daniela.haiduc@efama.org

Notes to editors:

About the European Fund and Asset Management Association (EFAMA):

EFAMA, the voice of the European investment management industry, represents 28 Member Associations, 60Corporate Members and 24 Associate Members. At end Q2 2020, total net assets of European investment funds reached EUR 17.1 trillion. These assets were managed by almost 34,200 UCITS (Undertakings for Collective Investments in Transferable Securities) and more than 29,100 AIFs (Alternative Investment Funds). More information is available at www.efama.org.

Follow EFAMA on Twitter @EFAMANews or LinkedIn @EFAMA for latest updates.