On 24 May 2023, the European Commission unveiled the most extensive reform of the EU legislative framework for retail investment to-date. As representatives of the European financial and insurance sector, we (AMICE, EACB, EAPB, EBF, EFAMA, ESBG, EUSIPA, Insurance Europe) are still assessing the full range of impacts and changes put forward in the Retail Investment Strategy (RIS) across multiple pieces of regulation: MiFID II, the Insurance Distribution Directive, the UCITS Directive, the Alternative Investment Fund Managers Directive, the PRIIPs Regulation and the Solvency II Directive.

Press releases

We work to promote a better understanding of the investment management industry and its contribution to growth, jobs and the economy through social media, press releases, in-depth interviews and media events.

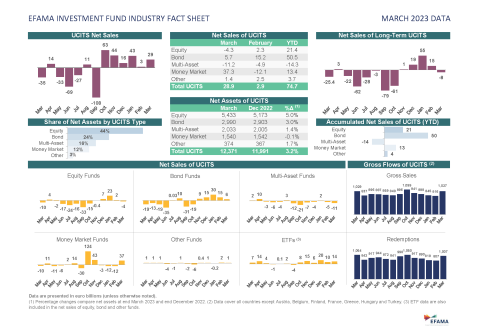

Strong net inflows in MMFs in March 2023

EFAMA has today published its latest monthly Investment Fund Industry Fact Sheet, which provides net sales data on UCITS and AIFs for March 2023, at European level and by country of fund domiciliation.

European Commission’s Retail Investment Strategy includes positive elements, however the impact of some initiatives remains unclear

The publication of the European Commission’s long-awaited EU Retail Investment Strategy is an important moment, as creating the necessary conditions to grow retail investor participation in capital markets is key for the future of both the European economy and EU citizens. Within the strategy, we see positive elements which the fund industry has long encouraged, such as digital-by-default disclosures, the preservation of both fee- and commission-based distribution models, and comparable rules for all types of investment products.

For interview requests or quotes, contact hayley.mcewen(at)efama.org