MiFID / MiFIR

The Markets in Financial Instruments Directive (MiFID) is a cornerstone of EU financial services legislation and is of direct relevance to asset management companies. In 2014, the European Commission adopted new rules revising MiFID, consisting of a Directive (MiFID II) and a regulation (MiFIR). Overall, MiFID II yielded positive results in terms of liquidity and transparency for investors.

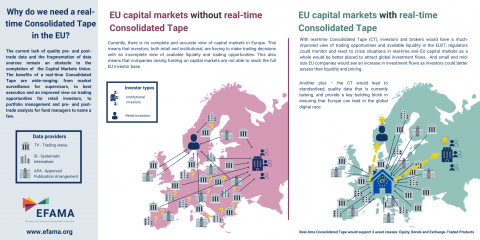

Among possible improvements to the MiFID framework, EFAMA encourages the creation of a well-structured, reasonably priced consolidated tape managed by ESMA and fed by all trading venues and systematic internalisers for all financial instruments. A second, long-term EFAMA objective is better enforcement of data providers’ existing obligation to provide market data on a “reasonable commercial basis”.

FinDatEx supports standardised technical templates

EFAMA's comments on ESMA's CP on integrating sustainability risks and factors in MiFID II

EFAMA – the urgency behind a consolidated tape for Europe | A buy-side view on consolidated tape and market structure reforms

The European Fund and Asset Management Association (EFAMA) has today published its position paper on the European Commission’s proposed Markets in Financial Instruments Regulation review which establishes a blueprint for a consolidated tape (CT) across Europe’s capital markets.

Joint Statement on EU Commission proposal for revised Market in Financial Instrument Regulation (MiFIR)

We see great value in the creation of a consolidated tape to support Europe’s capital markets. However, we qualify that statement with a reminder that the framework for a successful consolidated tape should

i) address the known market failure around market data costs,

EFAMA welcomes proposal on affordable consolidated tape - The association continues to urge action on market data costs

EFAMA is pleased to read today the details of a robust MiFIR proposal from the European Commission addressing key areas of reform around the creation of a consolidated tape (CT), along with adjustments to transparency requirements on trading.