EFAMA has some concerns with ESMA’s clarifications. In the consultation paper (CP), ESMA seems to have a very broad interpretation of the ‘multilateral systems’ definition under MiFID II and states that ‘systems where trading interests can interact but where the execution of transactions is formally undertaken outside the system still qualify as a multilateral system and should be required to seek authorisation’ (paragraph 36).

MiFID / MiFIR

The Markets in Financial Instruments Directive (MiFID) is a cornerstone of EU financial services legislation and is of direct relevance to asset management companies. In 2014, the European Commission adopted new rules revising MiFID, consisting of a Directive (MiFID II) and a regulation (MiFIR). Overall, MiFID II yielded positive results in terms of liquidity and transparency for investors.

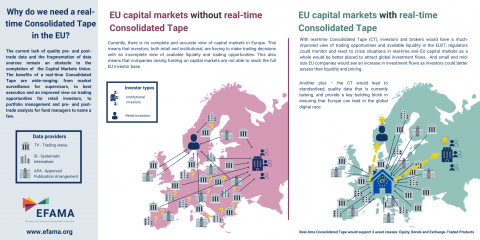

Among possible improvements to the MiFID framework, EFAMA encourages the creation of a well-structured, reasonably priced consolidated tape managed by ESMA and fed by all trading venues and systematic internalisers for all financial instruments. A second, long-term EFAMA objective is better enforcement of data providers’ existing obligation to provide market data on a “reasonable commercial basis”.

EFAMA's reply to ESMA's CP on MiFIR Review report on the obligations to report transactions & reference data

We disagree with an extension of its scope to UCITS’ and AIFs’ management companies to the scope of the reporting requirements imposed by MiFIR, Art. 26. This extension would be in breach of the principle of proportionality, as:

EFAMA comments EC CP on a Covid-19 Capital Markets Recovery Package

EFAMA appreciates the Commission's efforts in pursuing an alleviation of certain MiFID II requirements in the interest of promoting a swift recovery from the economic crisis precipitated by the Covid-19 pandemic (....).

EFAMA believes however that there are more effective ways to foster SME access to markets and urges the Commission to consider a set of further measures (...)

Ensuring a market structure and a transparency regime which facilitate liquidity, investors’ choice, and funding of companies | Joint statement

Well-functioning and liquid capital markets are fostered by an efficient market structure and supporting legislative frameworks. A diverse and efficient market structure reduces the costs of trading whilst promoting best execution. This optimises funding opportunities for issuers and maximises returns for investors and savers.

FinDatEx launches interim version of European MiFID Template

The Financial Data Exchange Templates (FinDatEx) platform today published an interim version of the European MiFID Template (EMT V3.1) which is available on the FinDatEx website. The purpose of this interim version is to answer the demand of product distributors and manufacturers to cope with the basic implementation of MiFID II ESG/SFDR principles, and in view of the misaligned application dates of SFDR Level 1, SFDR RTS and MiFID II delegated acts.

Financial Data Exchange Templates (FinDatEx) platform publishes European Feedback Template

Financial Data Exchange Templates (FinDatEx) platform published on 01 December 2020 the European Feedback Template (EFT V1). This template standardises the information to be sent back from the distributor to the manufacturer under the MiFID 2 target market requirements. This is the first European wide feedback template. The EFT and all other FinDatEx templates are not compulsory, provided to the industry free of charge and are free of any intellectual property rights.