EFAMA replied to a specific question on moving to stage 3 for the determination of the liquidity assessment of bonds.

MiFID / MiFIR

The Markets in Financial Instruments Directive (MiFID) is a cornerstone of EU financial services legislation and is of direct relevance to asset management companies. In 2014, the European Commission adopted new rules revising MiFID, consisting of a Directive (MiFID II) and a regulation (MiFIR). Overall, MiFID II yielded positive results in terms of liquidity and transparency for investors.

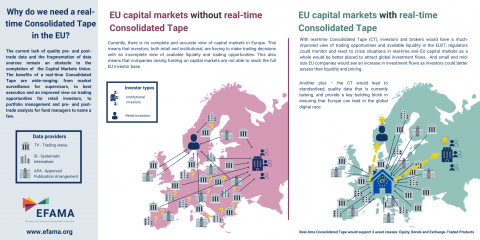

Among possible improvements to the MiFID framework, EFAMA encourages the creation of a well-structured, reasonably priced consolidated tape managed by ESMA and fed by all trading venues and systematic internalisers for all financial instruments. A second, long-term EFAMA objective is better enforcement of data providers’ existing obligation to provide market data on a “reasonable commercial basis”.

MiFID: EFAMA replies to ESMA consultation on RTS 2 Annual Review

ESMA consults on guidelines of the MIFID II appropriateness and execution-only requirements

EFAMA agrees in principle with many of ESMA’s suggested approaches in their consultation on guidelines on certain aspects of the MIFID II appropriateness and execution-only requirements. However, certain, essential elements still require further considerations before finalising these Guidelines.

EFAMA responds to IOSCO Consultation on Market Data in Secondary Equity Market

EFAMA supports the initiatives launched by IOSCO and other regulators (e.g. ESMA, FCA, SEC) to analyse and address the significant issues concerning market data in the secondary equity market.

EFAMA & EFSA joint letter on FCA wholesale market data study

The FCA’s recent report on the wholesale data market is an important and high-quality study which echoes many long-standing buy-side concerns. It finds evidence of unequal market power in terms of market concentration, highly profitable margins, opaque pricing practices, excessive charging, bundling practices and complex licensing agreements, all of which negatively impact data users. Much of this data is indispensable for users to stay in business and fulfil regulatory obligations.

New rules establishing EU consolidated tape will boost capital markets, but could still go further

Today’s European Parliament vote concludes the MiFID/R review process

Joint trade associations urge policymakers not to concede to suboptimal outcomes in MiFIR review

EU asset managers, banks and brokers are today urging policy makers not to concede to pressure which will lead to suboptimal outcomes in the review of the Markets in Financial Instruments Directive (MiFID/R).

3 Questions to Rudolf Siebel on Market Data Costs

Q #1 Have you witnessed an increase in the cost of market data over the last couple of years? If so, how can it be explained?