EFAMA replied to a specific question on moving to stage 3 for the determination of the liquidity assessment of bonds.

MiFID / MiFIR

The Markets in Financial Instruments Directive (MiFID) is a cornerstone of EU financial services legislation and is of direct relevance to asset management companies. In 2014, the European Commission adopted new rules revising MiFID, consisting of a Directive (MiFID II) and a regulation (MiFIR). Overall, MiFID II yielded positive results in terms of liquidity and transparency for investors.

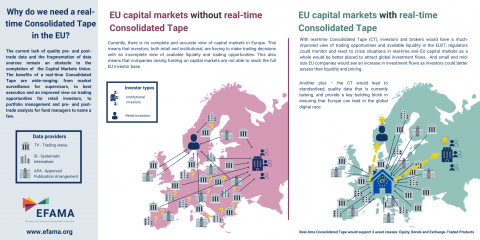

Among possible improvements to the MiFID framework, EFAMA encourages the creation of a well-structured, reasonably priced consolidated tape managed by ESMA and fed by all trading venues and systematic internalisers for all financial instruments. A second, long-term EFAMA objective is better enforcement of data providers’ existing obligation to provide market data on a “reasonable commercial basis”.

MiFID: EFAMA replies to ESMA consultation on RTS 2 Annual Review

ESMA consults on guidelines of the MIFID II appropriateness and execution-only requirements

EFAMA agrees in principle with many of ESMA’s suggested approaches in their consultation on guidelines on certain aspects of the MIFID II appropriateness and execution-only requirements. However, certain, essential elements still require further considerations before finalising these Guidelines.

EFAMA responds to IOSCO Consultation on Market Data in Secondary Equity Market

EFAMA supports the initiatives launched by IOSCO and other regulators (e.g. ESMA, FCA, SEC) to analyse and address the significant issues concerning market data in the secondary equity market.

EFAMA calls for changes to investor protection rules in MIFID II / MIFIR Review

EFAMA has submitted its  response to the European Commission's consultations on the review of the MIFID II / MIFIR regulatory framework, where it has outlined its recommendations on investor protection and capital markets and infrastructure.

response to the European Commission's consultations on the review of the MIFID II / MIFIR regulatory framework, where it has outlined its recommendations on investor protection and capital markets and infrastructure.

EFAMA's Director General Tanguy van de Werve commented: