Our associations are committed to supporting the transition to a more sustainable economy and

to tackling climate change that we consider a priority. We strongly support the EU objective of

transforming Europe into the first climate-neutral continent in the world by 2050 and are ready

to contribute as representatives of the financial sector.

Data

In the modern economy, data is increasingly becoming a strategic asset. This is particularly true for the asset management industry, where data forms the backbone of the daily activities and internal processes necessary to guarantee best practices in portfolio management.

Asset managers are major users of a variety of data, including market data, index data and, increasingly, ESG data. EFAMA advocates for, and seeks to support members’ access to, high-quality, standardised and comparable data at a fair price. EFAMA also encourages the creation of a well-structured, reasonably priced consolidated tape fed by all trading venues and systematic internalisers for all financial instruments.

Joint industry letter - Call for a centralized register for ESG data in the EU

Joint Statement on Market Data Costs

Reasonable Market Data Costs Benefits the Real Economy

The fundamental function of a trading venue is to match buyers and sellers of securities at a price that balances supply and demand through transparent rules and processes. The sale of market data is a related but separate by-product of that primary function.

EFAMA’s response to ESMA’s CP on data costs and consolidated tape

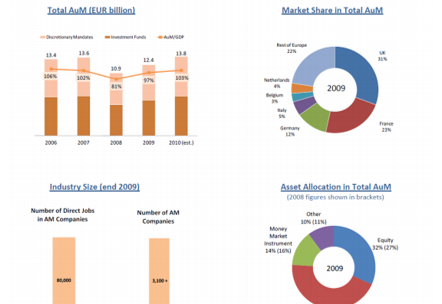

Annual European Asset Management Report - Report highlights key developments in the European fund industry

The European Fund and Asset Management Association (EFAMA) has released the 13th edition of its Asset Management in Europe report, which provides in-depth analysis of recent trends in the European asset management industry, focussing on where investment funds and discretionary mandates are managed in Europe.

The European Single Access Point: a powerful tool for investors to assess the ESG performance of companies

EFAMA sees the European Commission’s proposal for the creation of a European Single Access Point (ESAP) as a crucial step in addressing the limited availability and scattered nature of financial and sustainability-related entity information at EU level.

Statement on the release of the Oliver Wyman study ‘Caught on Tape’

“Oliver Wyman’s study ‘Caught on Tape’ provides a perplexing take on Consolidated Tape for Europe. Sure enough, it starts with accurate observations: the high number of trading venues in Europe, the resultant fragmented liquidity, unseen liquidity due to the lack of a consolidated tape, and the fact that leading markets like the US and Canada today benefit from a real time consolidated tape.