International Agenda

Whereas EFAMA’s primary focus is on EU financial services legislation, we also actively engage at a global level with international standard-setting bodies, such as IOSCO (of which EFAMA is an affiliate member), the Financial Stability Board (FSB) or the OECD, to name but a few. In this context, EFAMA strongly supports the development of mutually agreed international regulatory standards to reduce market fragmentation and facilitate cross-border business.

We also keep a close watch on regulatory developments in jurisdictions outside the European Union that are likely to significantly impact our members’ activities. For example, in recent years EFAMA actively engaged with foreign authorities on regulations limiting the distribution of European funds abroad. Examples include filings to the UAE Securities and Commodities Authority (SCA), the Indian SEBI, the U.S. SEC and the OECD.

EFAMA final letter to U.S. SEC re. proposed revisions to the Volcker Rule

EFAMA reply to FSB consultation on Incentives to Centrally Clear over-the-Counter (OTC) Derivatives

EFAMA Comment Letter to US OCC on Volcker Rule exemption (filed 21 Sept. 2017)

EFAMA responds to IOSCO's recommendations on sustainability-related practices policies, procedures and disclosures in asset management

EFAMA welcomes IOSCO's enhanced attention to transparency efforts supporting informed and qualified investment decisions in sustainability-related products. We support the adoption of such recommendations at the international level and believe IOSCO should leverage the experience with SFDR and Taxonomy in Europe to help establish consistent international standards, definitions and best practices.

In this response, we would like to highlight three pressing challenges deserving greater attention in the report from asset managers' perspective.

Naïm Abou-Jaoudé, CEO of CANDRIAM, elected new President of EFAMA - EFAMA appoints new Board of Directors

On the occasion of its annual meeting held on Friday 11 June, EFAMA’s General Meeting (GM) elected Naïm Abou-Jaoudé, CEO of CANDRIAM, as President for a two-year term, running until June 2023.

EFAMA Annual Review 2020-2021

It gives me great pleasure to provide you with an overview of our activities since our Ordinary General Meeting of last year.

Annual Review June 2019-June 2020

"It gives me great pleasure to provide you with an overview of our activities since our Annual General Meeting in Paris last year. While we were very much looking forward to hosting you all in Brussels this week, the current crisis and associated travel restrictions has forced us to improvise and turn our meeting into a virtual AGM.

EFAMA Market Insights | Issue #1 | Net outflows from UCITS in March 2020 - Industry weathers Covid-19 crisis

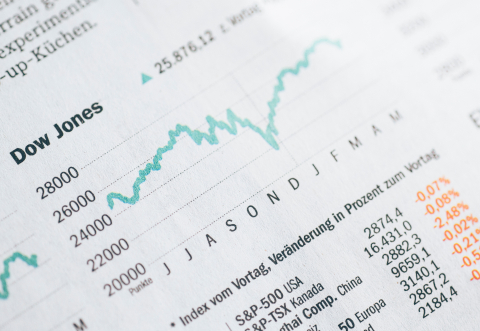

The Covid-19 pandemic significantly impacted financial markets. Stock markets across the world suffered a steep decline driven by lower economic growth and corporate profits. As anticipated, the crisis caused substantial net outflows from UCITS in March (EUR 313 billion). However, as a percentage of net assets, these outflows were no higher than in October 2008, at the height of the global financial crisis (2.9%).

Asset Management Report 2019

The EFAMA Asset Management in Europe report aims at providing facts and figures to gain a better understanding of the role of the European asset management industry. It takes a different approach from that of the other EFAMA research reports, on two grounds. Firstly, this report does not focus exclusively on investment funds, but it also analyses the assets that are managed by asset managers under the form of discretionary mandates. Secondly, the report focuses on the countries where the investment fund assets are managed rather than on the countries in which the funds are domiciled.