Ever since the term “shadow banking” has emerged from the FSB’s working circles in the immediate aftermath of the 2008 global financial crisis[1], our association has consistently argued that its use as a reference to regulated asset management companies and their funds is inaccurate and mis-leading.

Management Companies

EFAMA has been looking at legislative proposals with a direct impact on asset management companies and services, and closely follows any regulatory developments of critical importance to the sector. In addition to issues related to risk management and financial stability, high up on the agenda of EFAMA members is the framework for a prudential regime for Investment Firms (IFD/R), and related implementing measures directly descending from such framework.

EFAMA is focused on minimising the impact of the rules on asset management companies, in particular those holding a limited MiFID license. Key to the sector is the need for proportionality, especially firms that are not authorised to hold client money/securities, or to deal on their own account.

EFAMA's response to the EBA consultation on draft RTS criteria for the identification of shadow banking entities

Distance marketing of consumer financial services – Review of EU rules

EFAMA provided high-level comments to the Commission’s consultation on the potential review of the Directive on Distance Marketing of Consumer Financial Services.

We agree with the Commission’s interpretation that the Directive is seen as a “safety net” for financial services not already subject to product-specific legislation. Fund and asset managers are already subject to various, more stringent and detailed sectoral legislations, such as (but not limited to) UCITS, AIFMD and MiFID as well as the (more recent) Cross-Border Fund Distribution Directives.

EU retail investments: comprehensive strategy to increase retail investor participation required

EFAMA wholeheartedly supports a retail investment strategy that gives EU citizens the necessary tools and the confidence to put their savings to work by investing in capital markets.

European Statistics Q1 2020 | Alternative Investment Funds continued to attract net new money in Q1 2020 despite Covid19

The European Fund and Asset Management Association (EFAMA) has today published its Quarterly Statistical Release describing the trends in the European investment fund industry in the first quarter of 2020 with key data and indicators for each EFAMA member countries.

Investment Funds Distributor Due Diligence Questionnaire

Funds face unique challenges in performing intermediary oversight, and especially so because of MiFID II requirements, changing regulatory landscapes, and the absence of an industry agreed-upon standard between funds and their distribution channels. To help address these challenges, a dedicated working group developed a uniform due diligence questionnaire (DDQ) that will serve as the standard for investment funds (UCITS and AIFs) in performing onboarding and ongoing oversight of distribution channels.

AMIC and EFAMA update their report on Managing Fund Liquidity Risk in Europe

Asset Management Report 2021

This is our 13th edition of the Asset Management in Europe report, which provides an in-depth analysis of recent trends in the European asset management industry, focussing on where investment funds and discretionary mandates are managed in Europe.

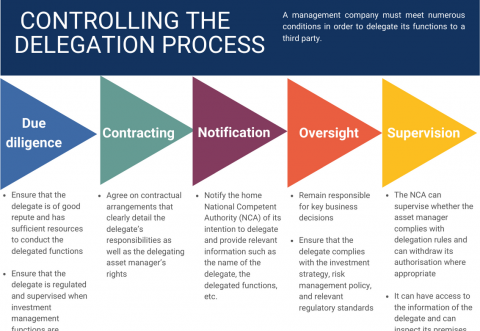

Infographic | The delegation process

The AIFMD is one of the pillars of EU regulation for investment funds, which will be crucial to the development of the Capital Markets Union (CMU) and the post Covid-19 economic recovery in the European Union. One subject that the AIFMD covers is the delegation process. We created the below infographic to shine a light on how delegation works under the current AIFMD, including how the delegation process is controlled, what activities can be delegated and what the benefits of delegation are for end investors and the asset management industry.

EFAMA Annual Review 2020-2021

It gives me great pleasure to provide you with an overview of our activities since our Ordinary General Meeting of last year.