MiFID / MiFIR

The Markets in Financial Instruments Directive (MiFID) is a cornerstone of EU financial services legislation and is of direct relevance to asset management companies. In 2014, the European Commission adopted new rules revising MiFID, consisting of a Directive (MiFID II) and a regulation (MiFIR). Overall, MiFID II yielded positive results in terms of liquidity and transparency for investors.

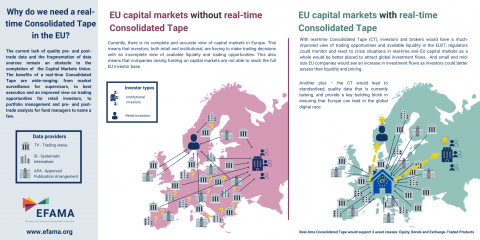

Among possible improvements to the MiFID framework, EFAMA encourages the creation of a well-structured, reasonably priced consolidated tape managed by ESMA and fed by all trading venues and systematic internalisers for all financial instruments. A second, long-term EFAMA objective is better enforcement of data providers’ existing obligation to provide market data on a “reasonable commercial basis”.

EFAMA's response to the EU Commission's consultation on the review of the MiFID II / MiFIR Regulatory Framework

Industry Association Letter on Impact of COVID-19 on Initial Margin Phase-In

EFAMA response to ESMA's CP on MiFIR report on Systematic Internalisers in non-equity instruments

European asset managers in full support of the European Parliament's proposal on Equities Consolidated Tape

In a letter to policymakers, 18 European buy-side firms state that only an Equities/ETFs tape that delivers data in real-time and that includes pre-trade data in the form of 5 layers of best bid and offer, will meet with the necessary market demand to make the Equities/ETFs Consolidated Tape commercially viable. A reasonably priced tape is also a precondition for success, they argue.

European asset managers express full support for the European Parliament’s proposal on Equities Consolidated Tape (MiFIR Review)

18 European buy-side firms, including Union, Generali, Invesco, Legal and General, Schroders and Baillie Gifford, have today declared their full support for the European Parliament’s proposal on the Equities Consolidated Tape. In a letter to policymakers, they state that only an Equities/ETFs tape that delivers data in real-time and that includes pre-trade data in the form of 5 layers of best bid and offer, will meet with the necessary market demand to make the Equities/ETFs Consolidated Tape commercially viable.

MiFIDII/MiFIR review will be key to the future success and competitiveness of the EU’s capital markets

The ongoing review of MiFIDII/MiFIR is an important moment for the future success of the Capital Markets Union project. The European Council adopted their position at the end of last year and the European Parliament is currently debating these future rules, with the expectation of a draft report by the end of the month.