EFAMA supports the European Commission's initiative to establish the European Single Access Point. We see it as a unique opportunity for the Capital Markets Union to centralise all publicly available ESG and financial transparency information data in one place.

Data

In the modern economy, data is increasingly becoming a strategic asset. This is particularly true for the asset management industry, where data forms the backbone of the daily activities and internal processes necessary to guarantee best practices in portfolio management.

Asset managers are major users of a variety of data, including market data, index data and, increasingly, ESG data. EFAMA advocates for, and seeks to support members’ access to, high-quality, standardised and comparable data at a fair price. EFAMA also encourages the creation of a well-structured, reasonably priced consolidated tape fed by all trading venues and systematic internalisers for all financial instruments.

EFAMA response to Commission consultation on establishment of European Single Access Point (ESAP)

EFAMA responds to IOSCO Consultation on Market Data in Secondary Equity Market

EFAMA supports the initiatives launched by IOSCO and other regulators (e.g. ESMA, FCA, SEC) to analyse and address the significant issues concerning market data in the secondary equity market.

EFAMA's reply to ESMA's CP on the Guidelines on the MiFID II / MiFIR Obligations on Market Data

EFAMA welcomes this ESMA initiative and we agree with the conclusions in the ESMA Report that there is an overall need to strengthen the laws applicable to data in connection with the MiFIDII/MiFIR Review, aside the implementation of a Consolidated Tape . We consider that the draft Guidelines will further strengthen the MiFID level 1 and level 2 measures and will foster the establishment of a cost-based approach for market data procurement. Therefore, we would be in favour of turning the proposed guidelines into binding regulation.

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.

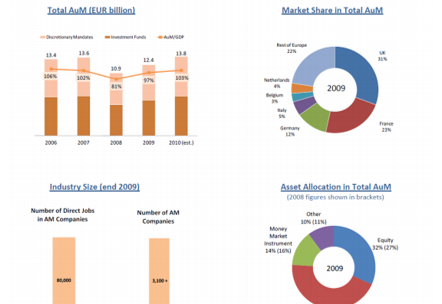

EFAMA publishes 2021 industry Fact Book - Report highlights key developments in the European fund industry in 2020

EFAMA has released its 2021 industry Fact Book.

The 2021 Fact Book provides an in-depth analysis of trends in the European fund industry, an extensive overview of the regulatory developments across 29 European countries and a wealth of data.

Joint statement by EFAMA and EFSA on Consolidated Tape and market data costs

The appropriate construction, and conditions for the usage, of a Consolidated Tape